Welcome to this special edition of Difficulty Adjustment!

We started our newsletter to give color to Bitcoin, Cryptocurrency, and Mining news and announcements. Today we awoke to the highly anticipated announcement that Hashrate Futures markets had begun trading on FTX crypto derivatives exchange.

What follows is our review of this new market. This is not a paid review or advertisement. None of what is shared should be considered financial advice, nor is it an inducement to make a trade or investment. We are miners and content creators, not financial advisors.

A New Market Forms

Hours ago, FTX crypto derivatives exchange launched a new market for bitcoin Hashrate Futures. In reality these contracts could more accurately be described as quarterly futures of average difficulty.

Although this is technically a derivative product, the underlying data is raw, with precedence being created each moment the market continues to trade.

Bitcoin miners, much like traditional commodities supply-side businesses, desire a hedge to de-risk operations. As such, there has been the demand for these financial instruments for a few years.

Terms and Conditions

For years the major questions which held back the release of hashrate futures were the contract term and how to value spot hashrate. FTX has taken a unique approach which may prove genius, or it could flop entirely. Only time and volume will tell.

FTX bitcoin hashrate futures are a Quarterly contract. This seems rather arbitrary, but such a contract requires a set timeframe for settlement. Similar to any other leveraged futures products - you can go both long and short on them.

There are currently three contracts available for trading: Q3 2020, Q4 2020 and Q1 2021. These trade as pure futures. Considering the available data on such financial instruments (aka none) these positions are an estimated guess or pure speculation, depending on the trader in question.

In July, FTX’s Q3 2020 future contract will transform. It will begin averaging each Bitcoin block difficulty in the given quarter. Towards the end of September, as contract expiration nears a close, the “fair price” should equate to the average block difficulty for Q3.

For those desirous of something more speculative, Q4 2020 and Q1 2021 futures are also live and trading. Traders can try and price in the difficulty for the coming quarters and as each quarter rolls over, a new futures contract will come out.

But why did FTX base the contracts on difficulty?

Simply put, actual network hashrate is nebulous. The best we can get is an estimate based on work done. Difficulty is the only metric that (over the long term) averages out with accuracy and a level of predictability. Hashrate remains an estimate, even on average, and in best cases it provides you with little more than a lagging price indicator. On the other hand, difficulty is exact and changes every two weeks with the new Bitcoin epoch.

A Market Well-Made

At the time of this issue’s drafting, these futures have been trading for a few hours. Their behavior so far may prove indicative of how this contract will behave.

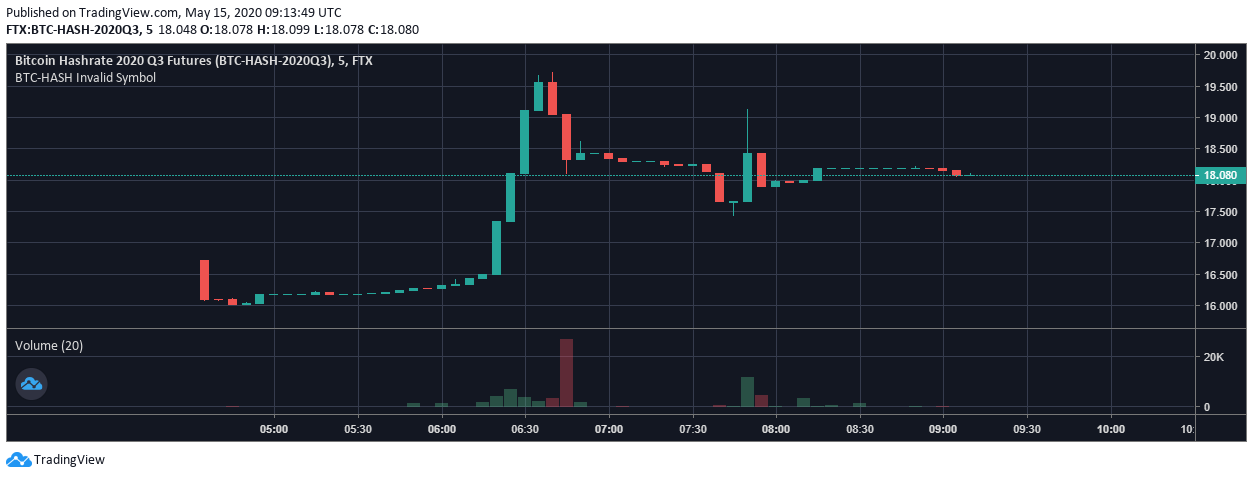

Each FTX bitcoin hashrate contract takes the current difficulty and divides it by 1 trillion. At present, the difficulty is 16.1 trillion and therefore contract price is in the high teens. Q3 2020 futures opened at 16.7, then stopped at 16.1 (the current difficulty).

When traders woke up (literally) to the market’s existence, volume arrived and the market immediately swung up, pricing in a 25% increase in average difficulty from now until September 2020. Somewhat predictably (in hindsight) this was perceived as an overreaction and sellers showed up, pushing the expected difficulty down to 18, which is a 10% increase from the current Bitcoin mining difficulty.

The Q4 2020 futures are now pricing in a 5% increase over Q3 2020 futures (Q4 is at 19.2) and the Q1 2021 are pricing in a 5% increase over the Q4 2020 futures (Q1 is at 20.2).

A Sign of Maturity

Ultimately each release of a financial product tailored to bitcoin miners’ needs indicates industry maturity. Financialization of mining allows for bitcoin’s correlation to traditional commodities like corn or oil, removing network uncertainty and calming price volatility. Adoption of futures speaks to the overall health of bitcoin as a network and store of value.

If these markets prevail, Bitcoin miners can estimate their revenue accurately and de-risk operations. This will prevent situations like the Black Thursday event in March caused by collateralized loan liquidations and selloff cascade.

-------------------------------

We are curious how non-mining investors will include these futures in their portfolio - do they increase diversification or will they be closely related to Bitcoin price?

Rather than spending millions on ASICs and a facility, speculators can bet on the overall direction of Bitcoin’s infrastructure. The FTX hashrate futures contracts can be treated as a derivative of the expectations of the entire mining ecosystem. The growth of the mining ecosystem is a fight between Bitcoin price and ASIC miner efficiency. If the electricity price is treated as a constant, hashrate can only increase with either higher ASIC efficiency or underlying asset price increase.

Using FTX futures contracts, market participants can therefore attempt to price in the expectations of a new efficient miner model or the expected increase/decrease in price of Bitcoin.In this way the Hashrate Futures product becomes an interesting miner sentiment derivative - as already evidenced by the cautiously optimistic expectation of a 25% increase in mining difficulty from now until Q1 2021.

We welcome these markets with excitement and trepidation. It is far too soon to pass judgement on product-market fit or the viability. Based on our research and that of the Hashr8 team, we estimate FTX’s bitcoin hashrate futures contracts will find success. Our hope is that they provide the hedging instrument large miners need. But time will tell.

-------------------------------

About FTX

FTX is a crypto derivatives exchange launched in 2019. They provide quite a few unique products and have quickly grown to become one of the more popular exchanges among retails traders. Sam Bankman-Fried, the CEO of FTX, is also the founder and CEO of Alameda Research. Alameda is a quant firm and OTC desk. They do over a billion dollars in volume each day and process a considerable amount of data.

Hashr8 Podcast

Sam was recently featured on an episode of Hashr8 Podcast. He shared his experiences starting Alameda Research and FTX. Also he discusses his team’s approach to creating new products.

Listen to the episode here.