This week’s HASHR8 Difficulty Adjustment release delivers:

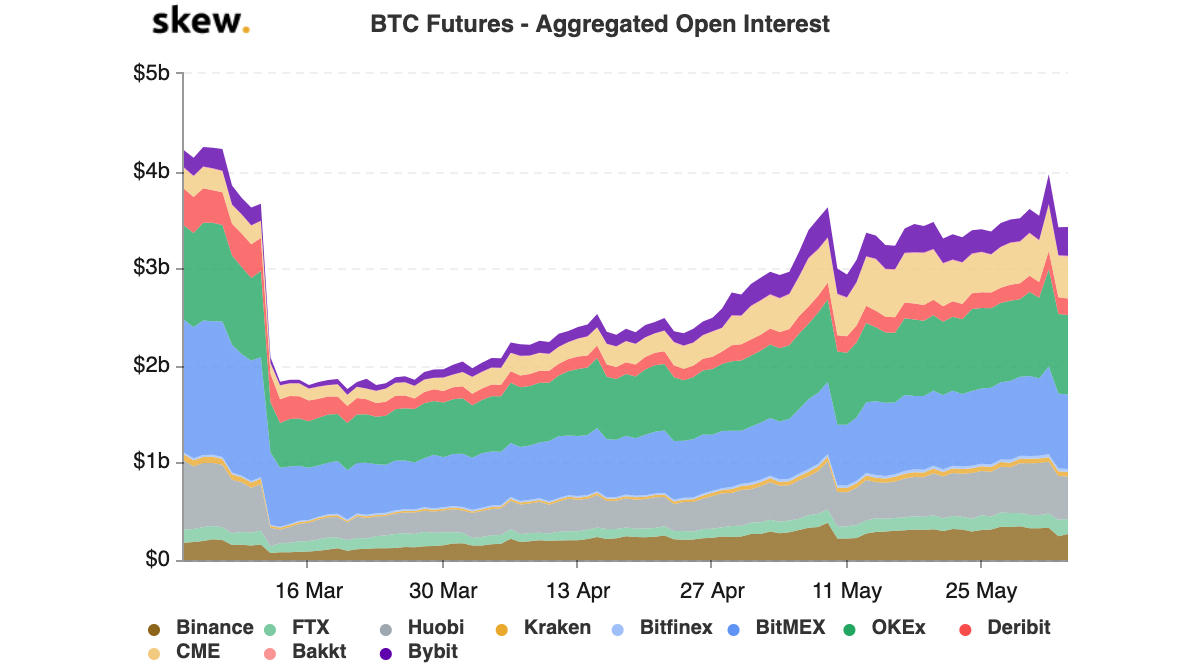

- CME Bitcoin futures trade in contango while open interest climbs to March highs.

- Transaction fees rise since the halving but the next difficulty adjustment will reveal the true state of transaction fees.

- The Bitcoin Mempool recently grew to over 90 MB amid slower block times. Developers explain why reaching maximum capacity is not a concern.

- The third model of the S19 series is released as competition intensifies between Bitmain and MicroBT.

- Rainy Season has arrived and Sichuan’s share of hashrate is expected to spike.

Want to stay on top of the most important developments in mining and Bitcoin? Subscribe to receive our weekly Difficulty Adjustment release.

📈 Bitcoin Market Digest - The Major Movements & Need-To-Know Developments

The CME Bitcoin June contract forms a high of 10565, slightly above the highs formed in the spot market in October 2019 and February 2020. Strong seller liquidity was found above these levels and price closed the trading day at $9,585.

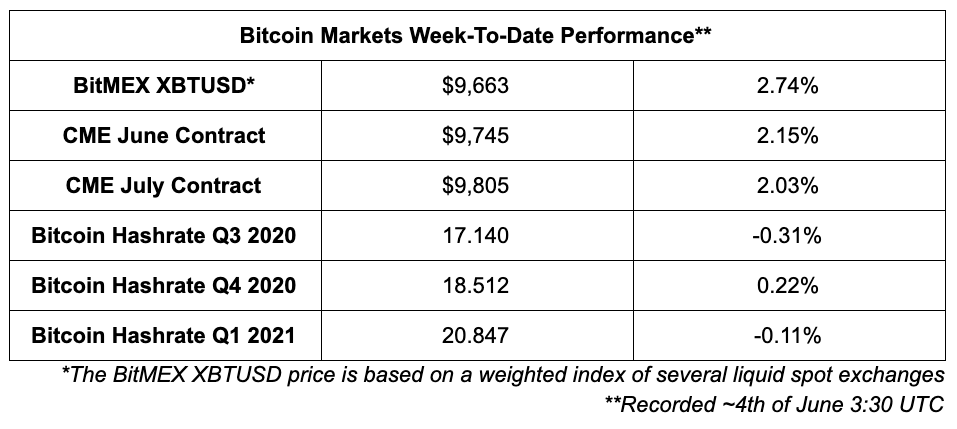

- The CME June and July futures currently both trade at premiums to the spot price.

- Open interest across all Bitcoin futures markets approached levels observed before the March price decline but the decline after price surpassed previous highs catalyzed roughly $500 million in liquidations

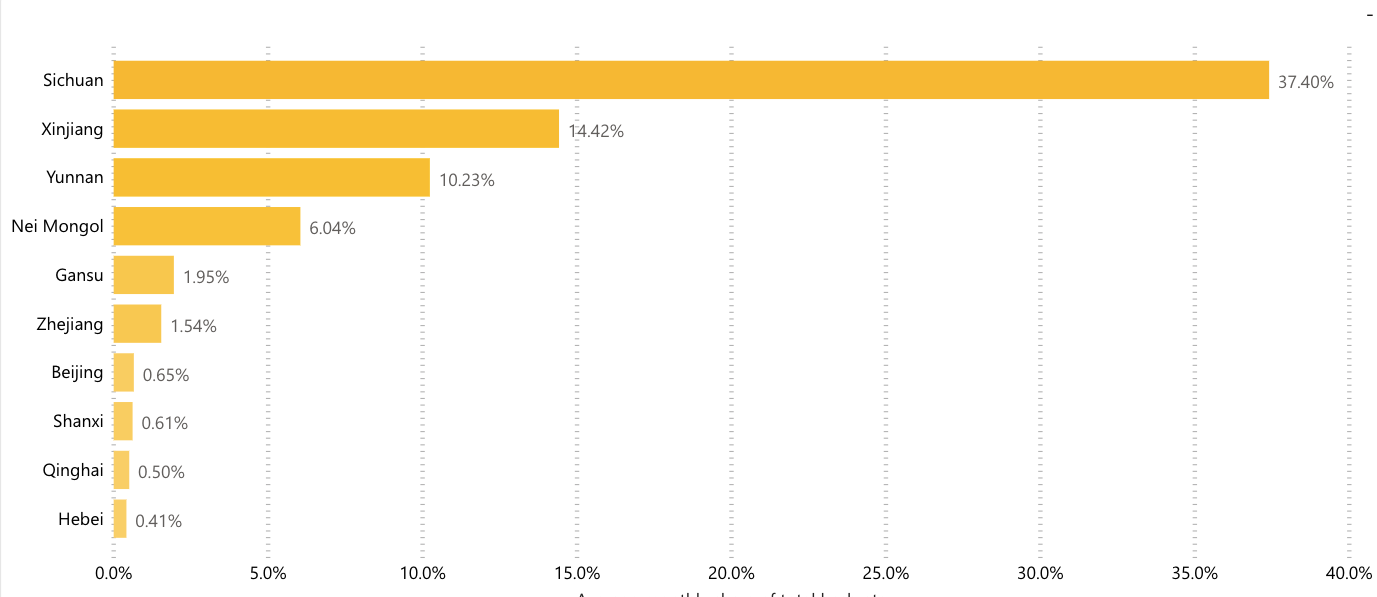

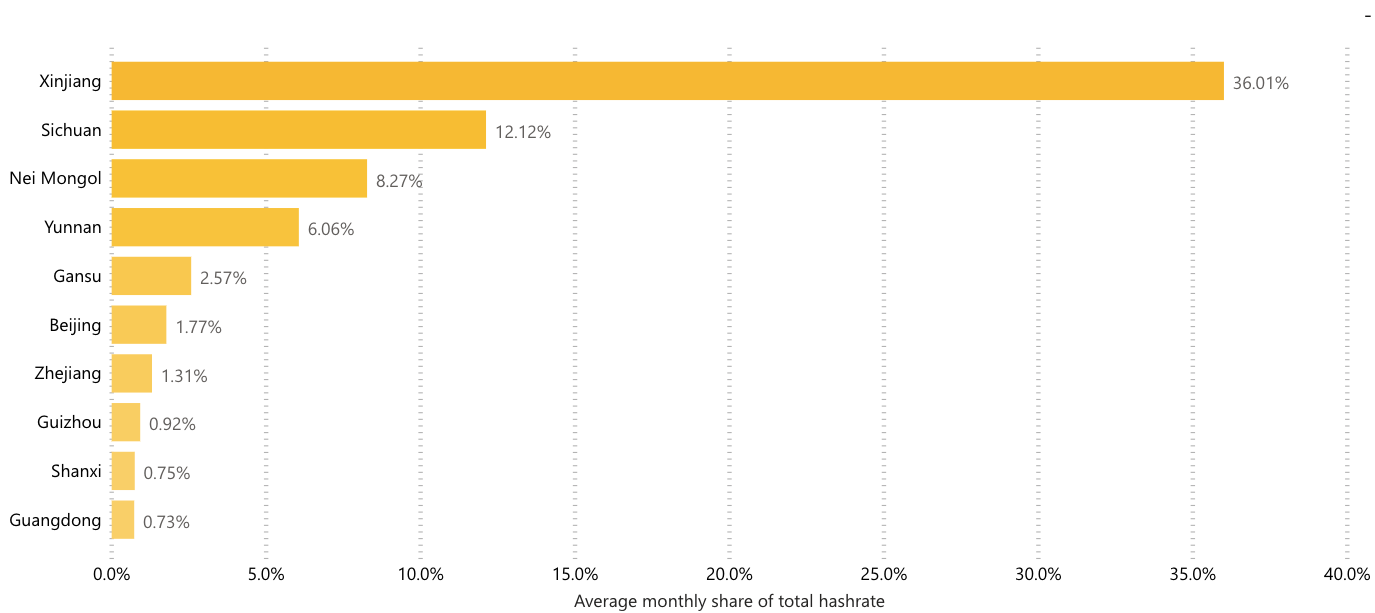

💦 Hashrate Share in Sichuan – Can you spot the difference?

Here are estimates for the Chinese distribution of hashrate in September 2019...

And here’s January 2020...

Do you know what the big difference is?

.

.

.

.

.

Rainy Season!

Rainy season runs from roughly April to October each year and results in huge amounts of hydropower generation in China’s southwestern provinces. With advanced hydropower infrastructure in provinces such as Sichuan and Yunnan, the natural result is an abundance of energy with insufficient industrial demand in the region.

The infrastructure to transport this energy to major consumers in the East is underdeveloped and much of this energy is destined to go to waste. Enter Bitcoin miners.

Sichuan transforms into the heart of the Bitcoin network hashrate during the rainy season. Miners can commonly negotiate sub-$0.03 per kWh energy deals.

F2Pool global business director Thomas Heller recently shared that hosting contracts are currently available to miners at $0.03 to $0.033 per kWh. Hosting contracts include a markup so the rates farm operators are accessing are below this.

Heller further detailed to us that farm operators are accessing rates in the range of $0.01 to $0.02 per kWh. Some farms are employing a profit share model where the farm splits the profits from the rig with the miner.

💲 Bitcoin Difficulty Adjustment to Reveal True State of Transaction Fees

The second post-halving Bitcoin difficulty adjustment draws upon us and will take place within the next 12 hours. Many miners immediately dropped below their operating breakeven levels when the block subsidy reduced. This was immediately evident in the longer block times and drop in estimated hashrate.

While many enthusiasts were excited to see transaction fees rise post-halving, the longer block times also make block space more scarce. The first adjustment post-halving resulted in difficulty dropping by 6% but this adjustment failed to completely account for the change in hashrate. The first adjustment also took into account the higher hashrate levels before the halving from blocks 628,993 to block 629,999 (all at a difficulty of 16.1 trillion).

Current estimates for the next difficulty adjustment anticipate a decline of ~10.2%. This highlights that a significant percentage of miners were operating just above the margin before the halving and couldn’t afford to continue deploying their computing power when the block subsidy dropped to 6.25 BTC.

Recent appreciation in Bitcoin price will alleviate the pressure for some inefficient miners who have managed to survive. The rewards from miners who have already been shut down will be redistributed to those more efficient miners who remain.

↗️ Mempool Growth

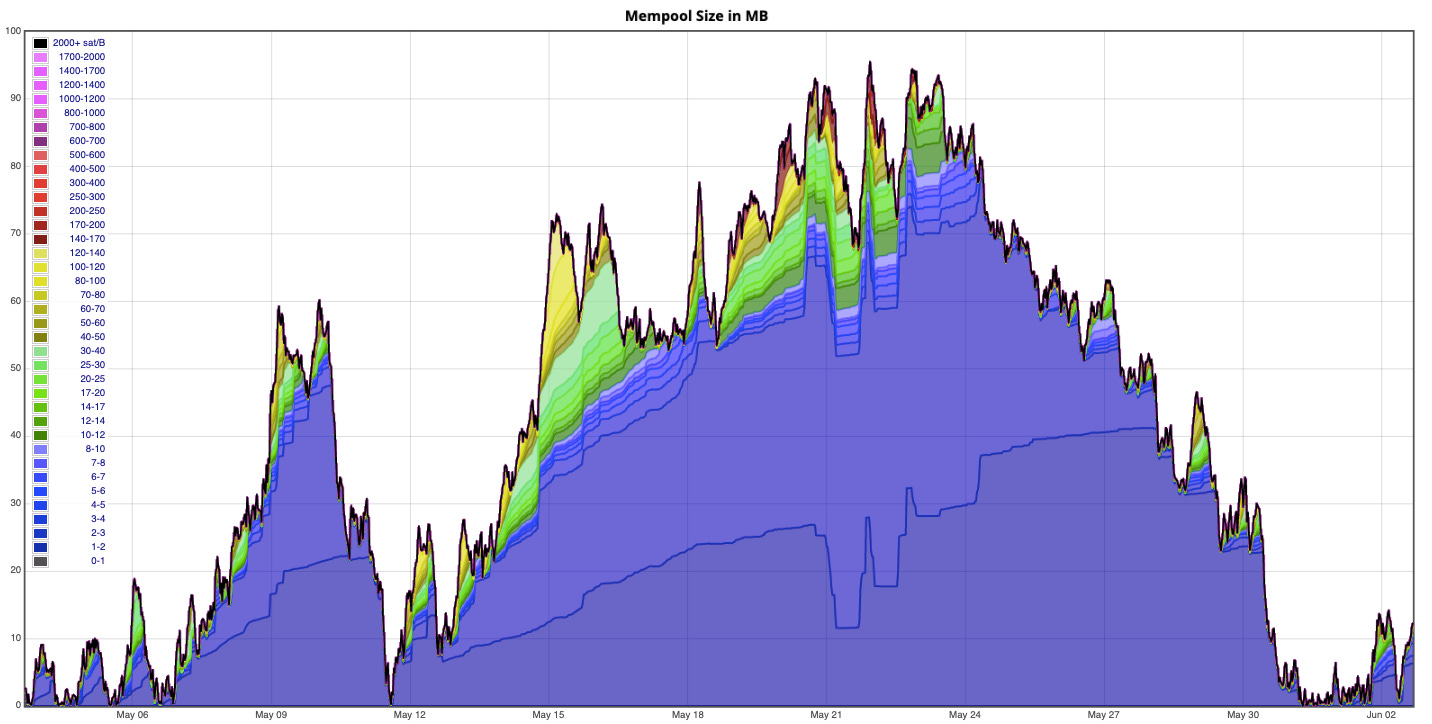

Speaking of slower block times, the Bitcoin mempool recently grew to over 90 MB according to data from jochen-hoenicke.de. Unconfirmed but valid transactions wait in the mempool until a miner includes them in a winning block.

The mempool has since reduced in size to under 20 MB but the growth did spark the question of what would happen if the mempool approached its maximum size of 300 MB. Bitcoin Stack Exchange users Murch and Andrew Chow explained that each node keeps their unique copy of the mempool. The mempool limit relates to the memory usage of each individual node which makes each limit dependent on an individuals’ node setup.

When a node reaches the maximum, the minimum acceptable fee rate will be increased meaning that transactions with the lowest BTC per byte fees will not be forwarded to this node. When the mempool size reduces, the nodes will decrease their minimum acceptable fee rate. Each node increases and decreases its minimum acceptable fee rate independently.

🥊 Rig Releases – Antminer T19 & AvalonMiner 1146 Pro Announced

Bitmain kicked off the month announcing the T19 which will be the third model in the Antminer S19 series. Retailing at $1,749, the Antminer T19 will have a hashrate of 84 TH/s with an energy efficiency of 37.5 J/TH.

Canaan will also be bringing a new rig to the market after announcing the AvalonMiner 1146 Pro. The AvalonMiner 1146 advertises a hashrate of 63 TH/s and an energy efficiency of 52 J/TH.

Canaan may be the only publicly listed Bitcoin ASIC manufacturer but the real competition rests between Bitmain and MicroBT. After reports of high failure rates with the S17 series, Bitmain will be looking to bounce back strong with the S19 series.

MicroBT has been putting the pressure on Bitmain by releasing more powerful and efficient rigs in both the Whatsminer M30S++ (112 TH/s) and the Whatsminer M30S+ (88 TH/s). They have also been winning over customers with Chase Blackmon of Immersion Systems revealing on the Hashr8 podcast that they put in a large order for latest-generation rigs with MicroBT.

Analysts have been noticing that Bitmain’s dominant position in the ASIC manufacture market has recently been fragile. Analyst Anil Kulla, a co-founder of research firm Delphi Digital, noted the following in a letter to subscribers –

“In an industry where your customers are sensitive to not only prices, but the delivery times and reliability of products - I can see competitors increasingly taking market share from Bitmain going forward.”

📡 Also On The Hashr8 Radar

Canaan reports a net loss of $5.6 million for Q1 2020. The share price recorded a steady decline in the weeks leading up to the earnings announcement and directly after. The share price is currently trading 58% lower than May highs. To add fuel to the fire, the 180-day IPO lockup period recently expired meaning that some pre-IPO investors can now sell their shares.

Ethereum network usage approaches its maximum capacity. Gas usage on Ethereum increases as a result of higher computational demand and a greater volume of computations. Gas usage has been above 90% of its maximum possible daily usage since early May. The increased usage has resulted in greater transaction fees for Ethereum miners. Average daily mining revenue has increased by 5.9% week-on-week according to data from CoinMetrics.

Chinese semiconductor firm SMIC files for an IPO on the Sci-Tech Board of the Shanghai Stock Exchange. The Sci-tech board was established to raise funds for technology companies whose strategies align with national interests. SMIC is far behind competitors such as TSMC and Samsung and is only now preparing to mass-produce 14 nm chips. However, the Chinese government will be interested in making the IPO a success as a domestic alternative to TSMC and Samsung becomes more important given the strengthening relationship between the current dominant fabricators and the US government.

🎧 Hashr8 Pods

Hashrate Futures & Difficulty Swaps with BitOoda – Sam Doctor and Adam Lambalot join the show to discuss the state of derivatives in the mining industry. The pair details how hashrate contracts and difficulty swaps work and why they’re important to miners.

Crypto Startups with Joel Birch – Joel Birch shares his experience building startups in the crypto industry. Birch explains his process of overcoming challenges and how he dealt with the steep regulatory hurdles in crypto.

Nic Carter: Bitcoin’s Energy Consumption – After publishing an op-ed on why the Bitcoin energy consumption debate is grounded in flawed assumptions, Carter joins the show to further explain his recent publication. Carter highlights how the growth in the Bitcoin network can make use of energy which would otherwise be wasted.

About Hashr8

HASHR8 is a community-driven bitcoin and crypto mining company focused on providing honest content, excellent products, and unparalleled customer service. HASHR8 produces weekly podcasts, videos, newsletters, and articles, as well as creating premium software products for bitcoin and cryptocurrency miners around the world. HASHR8 is Mining As It Should Be. Follow us on Twitter for all updates and new releases.