Bitcoin’s current price action looks more similar to the white lines painted at the side of a football field than the volatile price action of an emerging technology. Altcoins are rapidly appreciating while Bitcoin seems to have made a home in the $9k’s. Volume and volatility have evaporated from the market with trading volume in June being the lowest since March 2019.

With price being the most important variable playing into mining profitability, we explore how the current market conditions impact Bitcoin miners. We review how the extremely bullish narratives of the halving never came to fruition but how the expectation of higher prices led many to invest in mining infrastructure.

If you haven’t already subscribed to the HASHR8 YouTube channel, you’re missing out. Layer1 CEO Alex Leigl recently appeared to share his experiences setting up a full-stack mining operation in North America.

Miners may love to get technical in their discussions but nobody disputes that the most important variable playing into profitability is good ol’ fashioned price. When Bitcoin price goes up, miner margins widen and when price goes down, margins are squeezed.

But not only that. Price can be considered to be the thermometer of the entire industry. When price goes up, everything ramps up. Miners scramble to increase their exposure by expanding facilities or securing new investment. ASIC manufacturers seek to ramp up their limited production capacity as demand for new rigs rises above the supply coming to the market.

With the demand-supply imbalance comes higher prices. Prices of rigs get raised. Hosting rates go higher. Amid the hype, new retail investors get lured into cloud mining contracts. Upside price movements reverberate across the entire industry. Even as the hype begins to subside, miners are still operating at relatively high margins and keep expanding. Difficulty struggles to catch up with the rate of expansion as it lags hash rate deployed by two weeks. But the difficulty level eventually does catch up and the entire industry goes back to operating just above the margin.

But much of the investment that the hype brings remains. Higher prices bring a new wave of infrastructure into mining. Even expectations of higher prices can attract new capital into mining. Bullish narratives surrounding the halving over the past two years will have brought a myriad of Bitcoin miners into the industry ahead of what many expected to be the catalyst for Bitcoin’s next bull run. The widely discussed stock-to-flow model had the simple but flawed takeaway of $55k Bitcoin post-halving.

We are now two months post halving and the higher prices many anticipated have failed to materialize. Recently, Bitcoin has repeatedly failed to sustain prices above $10k. The promising price increases of Q2 2019 came to a quick halt near $14,000 and was preceded by a decline that ultimately brought the price back to $3,596 in March 2020. Moreover, Bitcoin difficulty is at record highs and pushing up the costs for those deploying SHA256 hash rate.

All-the-while, altcoins have recently been recording their most promising price action since 2017. The FTX shitcoin perpetual futures index has appreciated 101% since the start of Q2. For comparison, bitcoin has increased 38%. Both were closely tied until mid-May. At that point, Bitcoin entered a phase of choppy price action with repeated failures to keep valuations above $10k. The shitcoin index has continued to increase. Going into June, Bitcoin recorded its lowest trading volume since March 2019.

Furthermore, the altcoins leading the run-up have dominantly been non-PoW coins. Increased speculation in DeFi protocols has been a major allure for new capital. Speculative activities termed “yield farming” and “liquidity mining” have been given increased attention.

High APY rates available in major DeFi protocols have spurred new capital into the space. This new capital pushes up the tokens native to these DeFi protocols which further increases the APY rates accessible and thus creating a self-reinforcing cycle. In the past month alone, the total value locked in DeFi protocols has increased by $1.3 billion.

What does all this mean for Bitcoin? Price has been struggling to overcome key levels while the spotlight seems to have momentarily transitioned to altcoins and DeFi speculation. Bitcoin miners may not be seeing the lucrative conditions they anticipated but they are well positioned for when they do arrive. During the price increase of Q2 2019, average miner profitability reached close to $0.5 daily per TH deployed. However, miners who took this as a sign to set up or expand would have seen much less lucrative conditions by the time they secured hardware, facilities, and power. However, those who had put in the effort to set up while profit margins were tighter enjoyed profits above ~$0.25 for roughly three months. Since the halving, the value of hash rate has dropped to roughly $0.07 to $0.09 daily per TH based on data from Luxor Mining’s hashrate index.

Despite the sideways price action, Bitcoin hashrate has been steadily growing. Even though current miners suffer from tight margins, they are exchanging their older generation machines for the newest S19's and M30S's. This results in a higher hash rate being deployed overall. Furthermore, old mining rigs such as the Antminer S9 which may have been unprofitable six months ago are feasible to mine again during the Chinese rainy season. This year’s rainy season turned out to be extremely wet.

The appreciation in altcoins can be seen as a double-edged sword for Bitcoin. On the one hand, it takes some attention away from Bitcoin by attracting speculators to make speculative gains in extremely experimentative technology. On the other hand, this speculative activity drives new interest in cryptocurrency as a whole. This new interest is likely to end up in Bitcoin given that Bitcoin continues to be the bellwether of all cryptocurrencies. New capital would drive prices higher and may possibly provide the catalyst for sustained price increases.

In this scenario, the Bitcoin miners who set up in anticipation of higher prices and who have been able to survive both prolonged lower prices and the halving will be ready to reap the rewards. Those who wait until the next bull run to scramble after mining rigs will be left in a similar situation to any retail traders. By the time they will be ready to turn their rigs online, margins will be tightening and higher difficulty levels will be pushing costs up.

In the markets, smart money and institutions enter first and are ready to offload to retail at the top. Retail comes in last because they are positioned last in the pecking order. Smart money and institutions are scouring data to find asymmetric opportunities. Retail reads the newspaper and generally enters at peak hype. It may be an overly generalized archetype but look no further than 2017 for an example. Peak media publicity hit in Q4 and everyone plus their grandmother wanted in. This was the very point that the markets were about to turn.

In mining, the process is more amplified in some ways. The smart miners and institutions that can set up at low costs while margins are tight will be the first to reap the rewards when price increases. Once price and profit margins increase, retail is lured in but this is often the turning point. As costs catch up with miners and some drop below their breakeven levels, the miners who were ready before profit margins widened will be best positioned to purchase discounted rigs from those who capitulate. These miners have bigger balance sheets after being ready to capitalize on the widened margins.

But there’s no need to overcomplicate matters with mining-market archetypes and institutional versus retail models. The idea can simply summarized as follows. The miners who experience the good times are the miners that are prepared for the good times.

Ethereum Fees, Mining Policy, and GigaWatt Acquisition

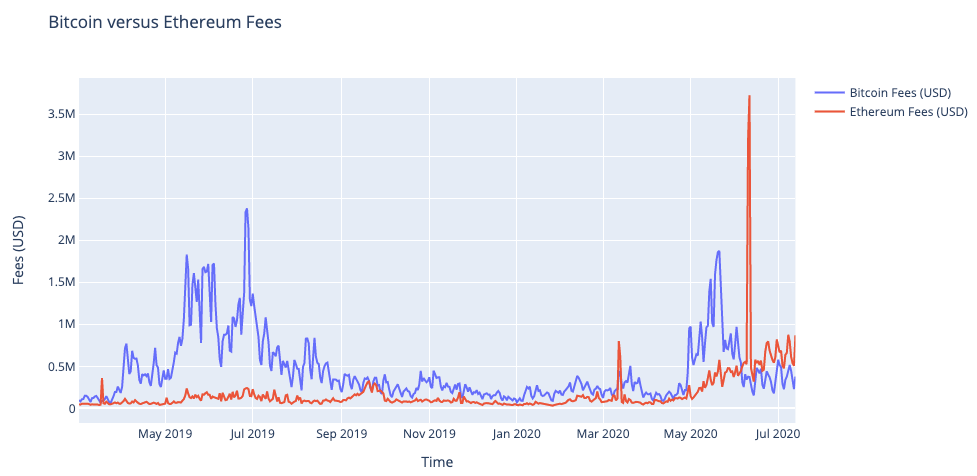

The longest streak of Ethereum miners earning more from transaction fees than Bitcoin miners continues. Miners of the largest altcoin network have earned more in USD from transaction fees than Bitcoin miners for 39 days. Ethereum transaction fees depend on both the total gas used and gas price. Given that the average gas price has remained relatively steady since mid-June, the increase in transaction fees have mainly been bolstered by an increase in gas used. Gas is a measure for the computational complexity of carrying out activities on the Ethereum. The increase highlights that Ethereum users have recently been executing more complex activities. The majority of these complex transactions are likely taking place in DeFi protocols.

The powers that be. There have been some key developments among governments in relation to Bitcoin mining. The Iranian government is requesting that miners register with the Ministry of Industry, Mines, and Trade. Miners are asked to disclose information related to their identities, facilities, and mining equipment. Furthermore, the Iranian government is reported to have recently issued 14 new licences to crypto miners and approved cutting 47% from their electricity tariff expenses. Iran is not the only country where authorities are taking action. Inflation-stricken Venezuela has become a hotbed of mining activity due to the troubled Venezuelan Bolivar and electricity being essentially free for citizens. However, authorities are reported to be extremely harsh on seizing equipment with some speculating that the government uses seized rigs for proprietary mining operations. A seizure on the 6th of July received publicity as an arm of the Venezuelan Ministry of Defense retained 315 Antminer S9 rigs.

GigaWatt, a former crypto mining operation in Washington State, is being acquired by a publicly-traded company. GigaWatt is being acquired by a subsidiary of New York-based Mechanical Technology, Incorporated (MTI). The acquisition comes after GigaWatt entered bankruptcy. MTI will take on obligations associated with lease and power contracts. The bankruptcy of GigaWatt in 2018 resulted in huge losses for investors in the company with creditors being owed roughly $70 million.

HASHR8: The Voice of Mining

Mining is the misunderstood heartbeat of blockchain technology. It fuels multi-million dollar IPO’s and drives institutional investors to big datacenters; it’s infrastructure is the subject of speculation and skepticism. Our global reach helps us demystify and broadcast the thoughts of industry leaders, and keep research firms, investors, and consumers up-to-date on trends and insights.