Skyrocketing value locked in DeFi was the catalyst that turned the tide in the crypto market. Before June, bullish expectations were dominated by halving hopes but a rapid rise in DeFi value emerged as the unlikely contender which shifted investor sentiment.

The bullish sentiment has found its way to market bellwether Bitcoin with price finally able to sustain values above $10,550. At the time of writing, Bitcoin is trading above $11,100 and perpetual futures rates are the most positive they have been since February.

The mining industry is entering unfamiliar territory. Bitcoin price is recording significant increases while miner costs have been pushed lower after difficulty dropping. Furthermore, operations and the supply chain of the largest ASIC manufacturer Bitmain have been split in two. Hash rate will likely struggle to keep pace with further price increases given that the delivery delays are guaranteed for orders of Antminer rigs.

In this release, we analyse how the crypto price appreciation has impacted miners. We dive into the lucrative conditions Ethereum miners are experiencing and the driver behind this. We also cover mining pool BTC.top launching a new venture and the speculative mania over Filecoin in China.

You can also check out our latest episode of BullishAF where Charles Read joins to talk about trading in DeFi. Charles discusses his framework for separating the projects with high upside potential from those that are too risky.

Have Mining Dynamics Changed After Altseason?

The phenomenal appreciation in the prices of altcoins has been the dominant discussion point in crypto over recent weeks. The spell of strong price action for altcoins arrived amid a prolonged period of low volume and volatility in Bitcoin.

But the positive performance of altcoins shifted investor sentiment to the bullish side and a significant increase in Bitcoin price followed. With price playing a key role in miner profitably, miner profit margins have increased.

Ethereum miners have been the main beneficiary of the price increase with heightened activity on the network raising transaction fees. The price increases in Ether have also outpaced the wider altcoin market further improving returns for Ethereum miners.

However, not all of the cryptocurrency price increases are manifesting in greater returns for miners. Much of the altcoin appreciation has been concentrated in non-PoW coins which may be reflective of investment in cryptocurrency infrastructure transitioning away from PoW.

In this week’s cover piece, we assess how the appreciation in crypto price assets has impacted miners. We also analyse whether an outperformance in some non-proof-of-work (PoW) assets may mark a long-lasting change in market and mining dynamics.

How Are Miners Impacted by Increasing Prices?

PoW miners effectively take a leveraged long position in the asset they mine. Since Q2, the profitability of this leveraged position has been diminishing amid declining prices and record difficulty levels.

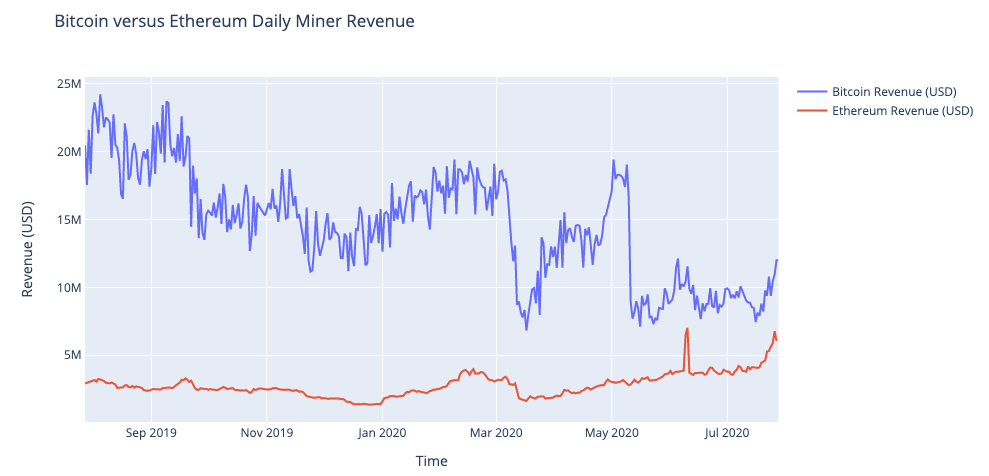

However, with the recent price appreciation, increases in returns for miners are outpacing growth in the underlying assets. In the space of a month, Ethereum increased 40% while the daily profit for the average Ethereum miner jumped 60%.

Bitcoin price was initially unimpacted by the rise in altcoin prices but the sustained altcoin appreciation was eventually accompanied by upward price movement in the Bitcoin market. The price increase has been boosting both the revenue for Bitcoin and Ethereum miners.

This boost in revenue comes at a time when the bottom line has also been improving for Bitcoin miners. The latest difficulty adjustment on the 28th of July resulted in a decline of 2.87% while the next adjustment is currently estimated to record another decline. The recent turbulence at leading Bitcoin ASIC manufacturer Bitmain may also act as a headwind for difficulty keeping pace with price increases. Under usual conditions, demand for mining rigs increases after price increases but the Bitmain troubles may result in insufficient rig supply to fulfil demand.

Furthermore, research by BitOoda estimated that the median cost per Bitcoin mined for miners is ~$5,000. BitOoda derived this by extrapolating data cost data collected from a sample of miners which they estimated included ~85% of the US hash rate and ~15% of the Chinese hash rate. This means that the average Bitcoin miners have been operating at margins of >100% while their bottom line has been improving.

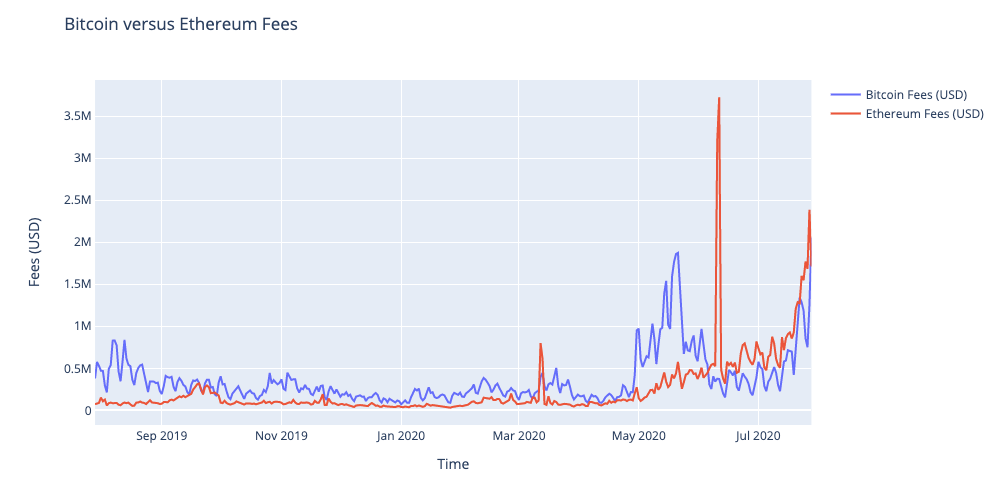

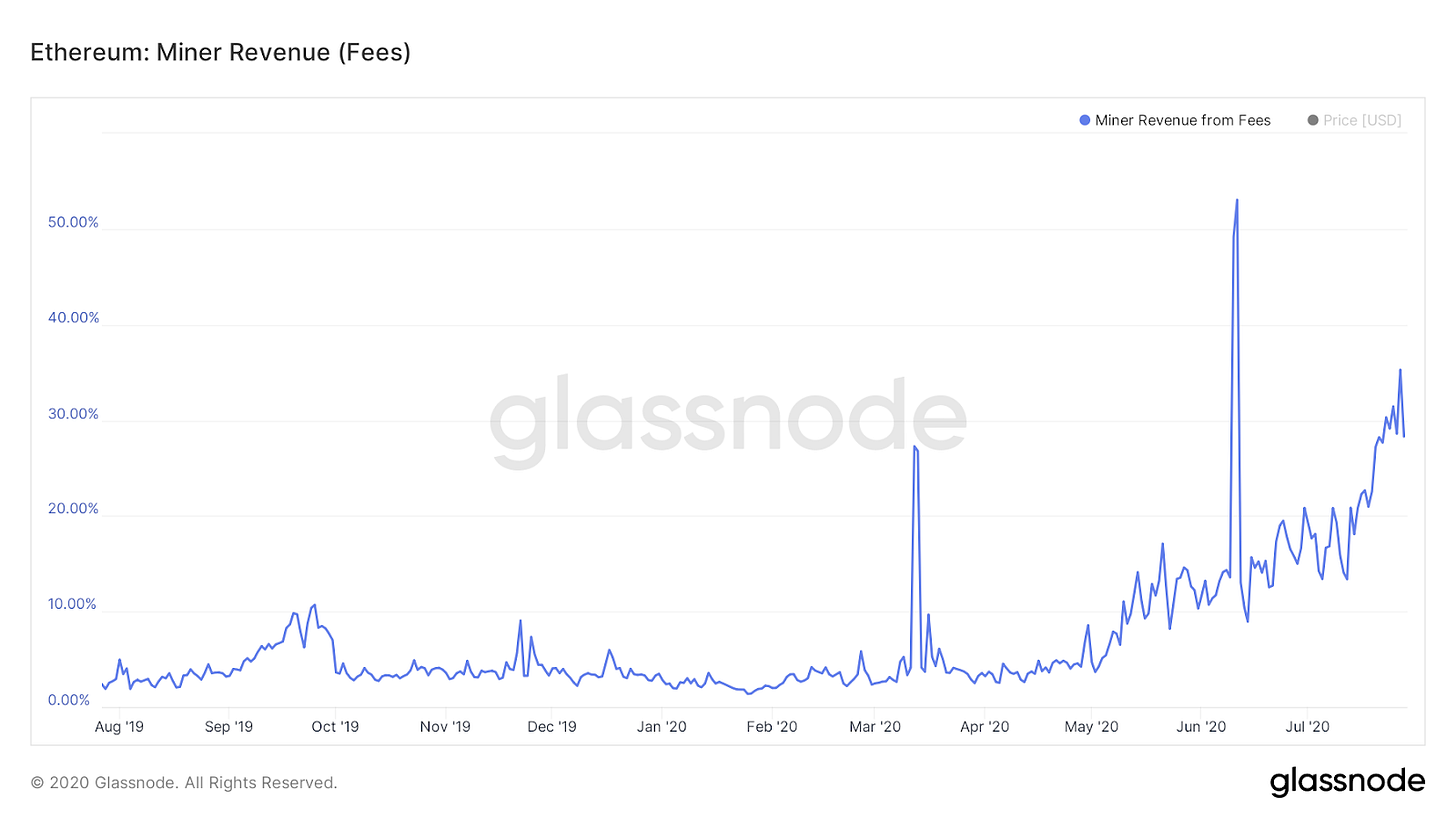

For Ether miners, the increased usage of tokens on the Ethereum blockchain has been the major driver behind the rise in revenue. The spike in the usage of these tokens has resulted in Ethereum users spending more gas and higher gas fees. These have both translated to higher transaction fees for Ethereum miners.

The increase in transaction fees paid by Ethereum users has made these fees a significant portion of the block reward earned by miners. At the time of writing, transaction fees account for ~30% of the Ethereum block reward. By comparison, transaction fees currently account for ~17% of the Bitcoin block reward which is a significant increase from the typical <2% pre-halving.

Are PoW & Cryptocurrency Market Dynamics Changing?

The increased fees for Ethereum miners was mainly driven by an increase in DeFi activity. The total-value locked in DeFi has increased by 450% since the start of the year. Despite DeFi tokens being key drivers in the altcoin appreciation, they are ultimately tied to Ethereum’s PoW given that they exist as assets on the Ethereum blockchain. But does the appreciation in non-PoW assets mean that the dynamics for mining are changing?

Overall, the increase in PoW assets has been broadly in line with the overall altcoin appreciation with some outperforming and others underperforming. Over the past 30 days, the altcoin market cap according to Coinmarketcap data appreciated 33.5%. Large-cap PoW coins Ethereum and Litecoin outperformed this while Bitcoin and Bitcoin and Bitcoin Cash underperformed.

The price performance of privacy PoW coins Zcash and Monero were also broadly in line with the return of the wider altcoin market. Monero and Zcash increased by 30% and 34% respectively.

However, the coins of some strictly non-PoW networks did outperform the broader altcoin performance. For instance, Solana appreciated 121% over the past 30 days while Cosmos Atom tokens increased 51%.

However, these coins are less liquid making them subject to greater price appreciation when there is demand-side pressure. Cosmos and Solana have market caps of $724 million and $31 million respectively. The amount of capital which would be required to catalyze a 121% increase in a $200-billion market cap asset such as Bitcoin would be orders and orders of magnitude greater than what would be needed to spark a 121% increase in an asset with a market of $31 million.

In summary, the recent price increases of cryptocurrencies have been resulting in extremely lucrative conditions for both Bitcoin and Ethereum miners. Ethereum miners are particularly benefiting from higher transaction fees which have mainly come from spiked activity in DeFi altcoins. Bitcoin miners are in a unique position where their costs are dropping while price increases. The turbulence in Bitmain will act as a headwind to raising Bitcoin miner costs as the biggest supplier of rigs may face issues fulfilling market demand. Finally, the dynamics of PoW mining and the cryptocurrency market have not radically changed as a result of altseason. Many of the altcoins appreciated are ultimately tied to PoW networks. Those non-PoW altcoins that have drastically outperformed the market are typically less liquid and require far less buying pressure for significant price increases. PoW asset returns have broadly been in line with those of the overall market.

What Miners are Monitoring

Bitmain operations and supply chain split.After an intense and ongoing power battle between Bitmain co-founders Jihan Wu and Micree Zhan, the operations and supply chain of the company is set to split in two. Jihan Wu has established a new entity in Shenzhen which will build out a manufacturing and supply chain which is separate from the one Bitmain has used to date. Micree Zhan returned to Bitmain in June and took control of a Shenzhen subsidiary which was key to Antminer rig delivery. It now looks likely that we will have two distinct entities delivering rigs. Many questions remain over how the two entities will coexist. It is uncertain who will take control of the Antminer brand. It was announced that Antminer shipments due at the end of June will be further delayed.

BTC.top launches “joint mining” venture.Chinese multi-currency mining pool BTC.top is launching a new venture which aims to reshape the cloud mining business model. In the new model, called “joint mining”, miners start to pay fees on contracts only after the initial investment is recuperated. After this point, contract purchasers pay 17.5% to 30% in fees. BTC.top launched the website b.top to host the “joint mining” platform. However, users are charged the electricity cost from the start of the contract.

Filecoin speculation craze in China. Chinese investors are wildly speculating on the future of Filecoin. A decentralized data storage network by Protocol Labs, the Filecoin network will have a token to incentivize adoption. However, the network remains in its test phase and key details relating to how mining will work on the network are yet to be released. Nonetheless, upwards of $10 million in trading volume is being carried out daily for the Filecoin futures tokens which is in place to represent a claim on Filecoin tokens when the mainnet launches. Daily trading volumes above $50 million were regularly recorded in June. It is not yet clear how the Filecoin futures tokens will settle for actual Filecoin mainnet tokens. Furthermore, Chinese companies have pushed ahead with releasing hardware for mining the network with Coindesk reporting that sales volumes of tens of millions are being recorded by some of these companies.

About HASHR8

Mining is the misunderstood heartbeat of blockchain technology. It fuels multi-million dollar IPO’s and drives institutional investors to big datacenters; it’s infrastructure is the subject of speculation and skepticism. Our global reach helps us demystify and broadcast the thoughts of industry leaders, and keep research firms, investors, and consumers up-to-date on trends and insights.