This week’s HASHR8 Difficulty Adjustment delivers:

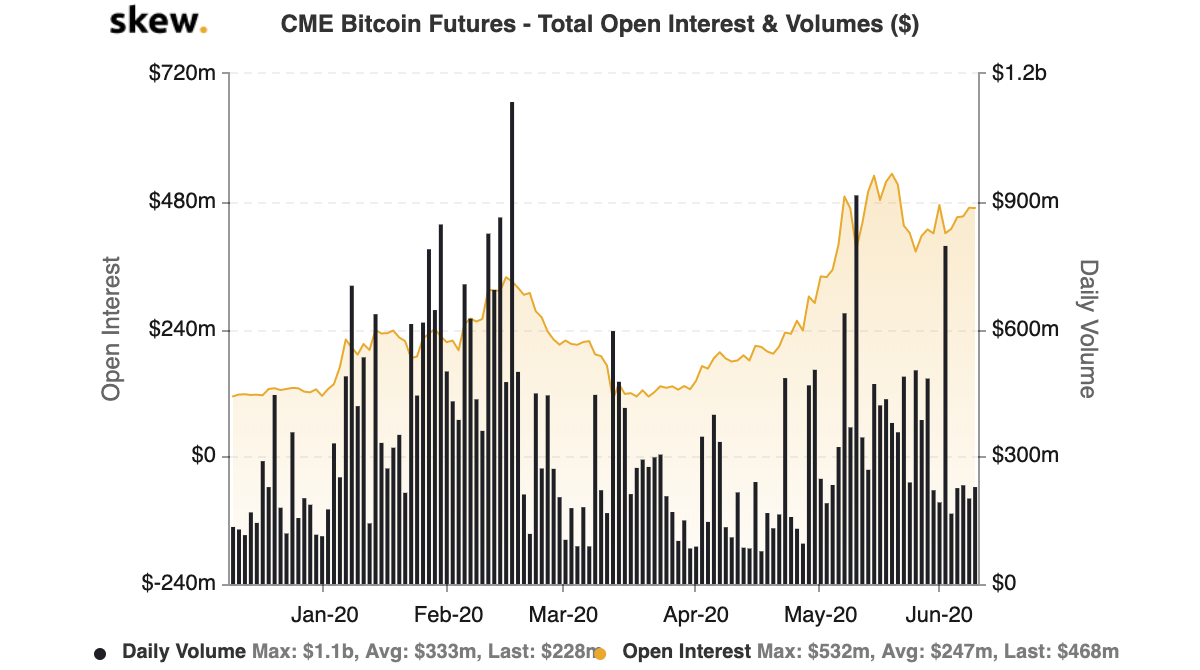

- Bitcoin CME contracts open interest approaches record highs

- How two downward difficulty adjustments have made it feasible for some S9s to come back online.

- How Sichuan miners set up operations to skirt national regulation

- Bitcoin Core bug cleanup in 0.20.0 release

- Bloomberg research report anticipates $20k Bitcoin this year

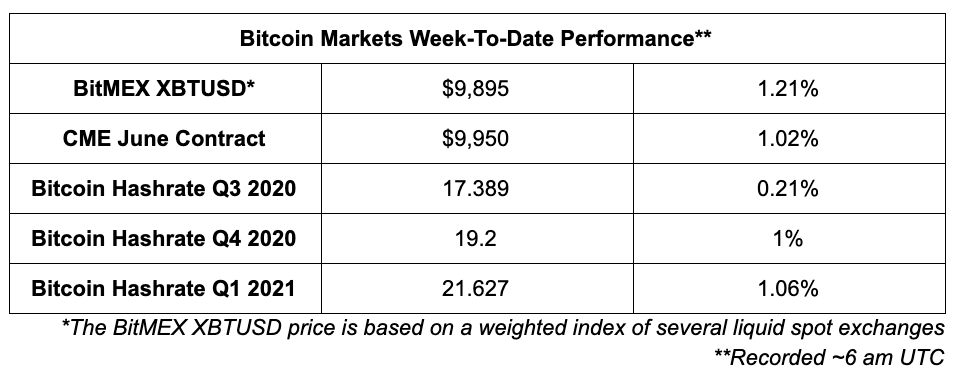

📈 Bitcoin Market Digest – CME Open Interest Approaches Record Highs

- Bitcoin has mostly traded in the high $9k’s in recent days after repeated failures to sustain price levels above $10k

- CME open interest approaches record highs highlighting increased interest in Bitcoin speculation from institutions.

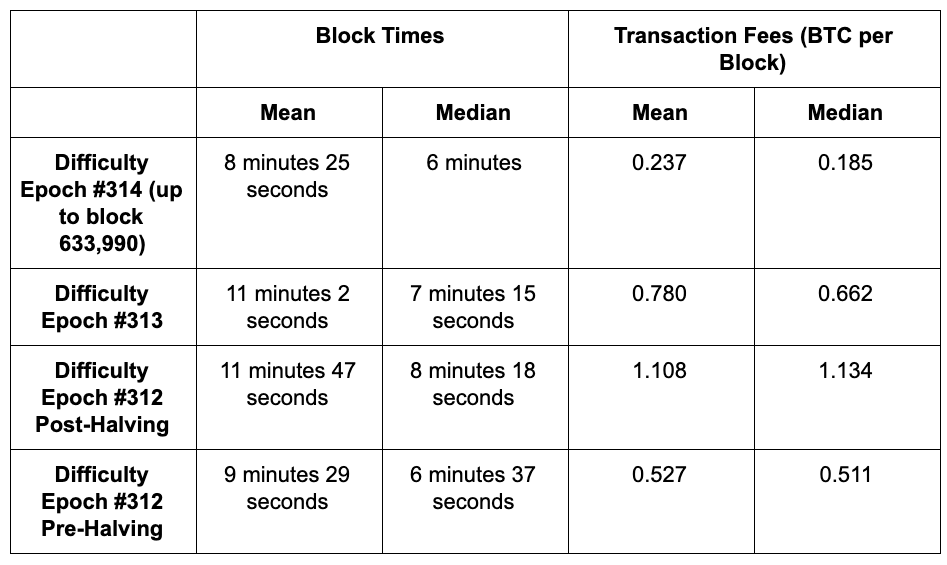

⏱️ Block Times Speed Up Naturally Reducing Transaction Fees

We analysed almost 5,000 blocks over the past three difficulty epochs to get an idea of how block times and transaction fees have adjusted since the halving. With the difficulty after adjusting downward by 14.7% since epoch 312, block times have been faster and transaction fees have naturally declined from their post-halving spike.

With difficulty levels close to record highs immediately post-halving, block times became slow and transaction fees rose to an average of 1.1 BTC per block. Fees have typically represented a low percentage of the block reward a miner earns (<5%).

However, after the halving, the percentage fees represent of the total block reward rose to over 25%. After two downward difficulty adjustments, block times have since sped up and fees have declined

The lower difficulty levels also increase the feasibility for mining with old-generation hardware which will partially explain the faster block times. It was estimated that S9 generation hardware represented 23% of the network hash rate before the halving.

Miners with this generation of hardware would have been most impacted by the decline in block subsidy. The lower difficulty levels will have made it possible for some S9 rigs that were shut down to come back online again. However, this grace period is setting up to be short-lived. Difficulty is currently estimated to increase by ~14.8% at the next adjustment in roughly five days.

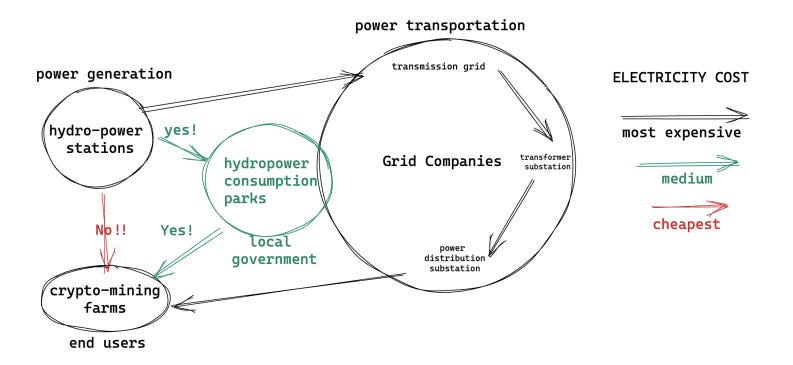

💧Sichuan Miners Skirting National Regulation

In last week’s release, we detailed how hash rate share is expected to increase in Sichuan province as the rainy season hits. However, the policy has unsurprisingly been uncertain as one document from the Financial Administrative of Sichuan orders government offices to guide mining operations to cease. But the majority of mining operations have established relationships with local governments making them immune to such orders.

In RelayNode China, Jane Wu explains how crypto mining firms in Sichuan set up facilities close to and sometimes within hydropower stations to skirt national regulation. The national regulation requires regulatory approval for off-grid sales of electricity.

The relationship is illustrated in the below graphic, with direct sales from hydropower stations to miners being prohibited. But sale through an entity which is connected to the hydropower station or one approved by the local government is permissible.

🕷 Bitcoin Core 0.20.0 Release

Bitcoin Core, the most widely used Bitcoin software client, has released its 0.20.0 upgrade. The latest release mostly cleaned up bugs. Some notable updates include the removal of the BIP70 payment protocol and the addition of the assumeutxo feature.

The BIP70 payment protocol was introduced to allow a sender and merchant to communicate extra information to one another. However, the protocol also introduced security vulnerabilities. The removal of the BIP70 payment protocol has also paved the way for Bitcoin Core no longer using the OpenSSL software library. The dependency on the OpenSSL software library sparked several short-term emergency upgrades in the Bitcoin Core software. With the BIP70 payment protocol being the last remaining part of the Bitcoin Core codebase depending on OpenSSL, its removal has also allowed the removal of OpenSSL.

The addition of assumeutxo enables Bitcoin Core 0.20.0 to take a snapshot of the UTXO set at a specific block height. This snapshot can be shared. Future releases will allow new nodes to start validating the network immediately from the snapshot time until the background check of the blockchain is complete.

Overall, Bitcoin Core 0.20.0 was a significant upgrade with bug cleanups, optimization fixes, and better error handling for wallets and miners. Onwards and upwards!

📊 Bloomberg Forecasts $20,000 Bitcoin

“Bitcoin will approach the record high of about $20,000 this year, in our view, if it follows 2016’s trend” Bloomberg Crypto Outlook Report

A recent report released by Bloomberg anticipates Bitcoin price returning to $20k highs this year. The report highlights several reasons to be optimistic regarding Bitcoin price. Rising CME futures activity and increased purchasing from demand-side institutions such as Grayscale strengthen the price prospects for Bitcoin. The strengthening narrative of Bitcoin being a digital gold is also detailed with recent central bank stimulus burgeoning this view.

Although “Bloomberg forecasts $20k Bitcoin” certainly makes for a good headline, the reasoning behind picking the $20,000 figure leaves a lot to be desired. The anticipation of an increase to $20k was based on drawing comparisons to Bitcoin price behaviour in 2016. After declining in 2014, Bitcoin price reclaimed 2013 highs after steadily appreciating over 2015-2016. Similarly, Bloomberg argues that Bitcoin may be setting up to reclaim 2017 highs after declining in 2018 but steadily recovering in 2019-2020.

However, market dynamics are constantly shifting and the fact that current price behaviour is similar to one of the past does not guarantee that price will continue to develop in the same manner. Just look at all the forecasts for 2020 pre-halving price increases based on how price behaved in the first two halvings of 2012 and 2016.

Nonetheless, if Bitcoin does reach $20k, it will undoubtedly be a major boost for Bitcoin miners globally. Margins will widen and manufacturers will likely be scrambling to provide rigs to a bullish market.

📡 Also On The Hashr8 Radar

Taiwan Semiconductor (TSMC) may be forced to restrict sales to Chinese company Huawei.TSMC recently unveiled plans for a $12 billion fabrication facility in the United States. The US Commerce Department has proposed amending chip export rules which may prevent TSMC from selling to Hauwei’s chip division HiSilicon. TSMC Chairman Mark Liu is confident TSMC can quickly fill the gap in revenue if the amended rules materialize.

An Ethereum user sending a transaction of 0.55 Ether paid a transaction fee of over 10k Ether (~$2.65 million). The transaction was mined by the biggest Ethereum mining pool Spark Pool.

Coinbase has created quite the stir after striking deals with the US government to develop a cryptocurrency investigation tool. Called “Coinbase Analytics”, the tool will provide blockchain analysis services to federal agencies including the DEA and IRS. The news sparked outrage and outflows from the exchange spiked.

🎧 Hashr8 Pods

Hashrate Futures Panel – The launch of hash rate derivatives by FTX has created a lot of hype. Four panellists with deep expertise in both mining and derivatives discuss the nuances of these products and what it means for the mining industry. Here’s the lineup:

- Hosted by HASHR8 CEO Whit Gibbs

- FTX co-founder Sam Bankman-Fried

- HASHR8 Director of Research John Lee Quigley

- Luxor Mining co-founder Ethan Vera

- Anicca Research founder Leo Zhang

About Hashr8

HASHR8 is a community-driven bitcoin and crypto mining company focused on providing honest content, excellent products, and unparalleled customer service. HASHR8 produces weekly podcasts, videos, newsletters, and articles, as well as creating premium software products for bitcoin and cryptocurrency miners around the world. HASHR8 is Mining As It Should Be. Follow us on Twitter for all updates and new releases.