Bitcoin mining companies are an often-discussed revenue-centric alternative to investing directly in cryptocurrencies, but position sizing can be difficult to gauge as they remain highly correlated to bitcoin while bringing additional volatility to a portfolio.

Thanks to the Data Always newsletter for this guest post.

The main reason that bitcoin miners are an attractive addition to a portfolio is that as the price of bitcoin rises, logistical difficulties prevent new miners from coming online and arbitraging the now more profitable environment. As can be seen in the figure below, revenue per hash is heavily correlated with the price of bitcoin.

Although it seems from the figure above that one would be better off simply buying bitcoin, one must remember that revenue is not an asset – revenue is used to acquire either bitcoin or more hash power, both of which lead to exponential increases in value. Furthermore, revenue is balanced against costs to generate profits: with constant costs an increase in revenue has an outsized effect on traditional valuation metrics.

For example, if costs were traditionally 50% of revenue, and revenue doubles, this leads to a tripling of the original profit.

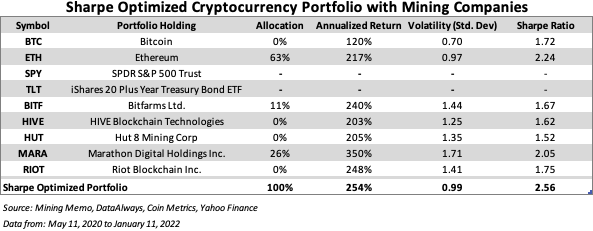

Cryptocurrency portfolio

Beginning with a portfolio construction of bitcoin, ether, and various mining companies we generate a risk curve by running millions of Monte Carlo simulations to find the optimal risk-adjusted balance.

We decided to focus on the performance of bitcoin mining companies during a bull market because, as higher-volatility investments, they are likely to suffer outsized drawdowns in prolonged bear markets.

Throughout this halving cycle, the correlation between bitcoin and bitcoin miners has been sufficiently large that the Sharpe optimal portfolio would have contained no bitcoin. Diversifying across ether (which provided the highest individual risk-adjusted returns across all options sampled) and well-performing miners allowed for a doubling of expected investment returns while adding only 40% relative volatility compared to a bitcoin-only portfolio.

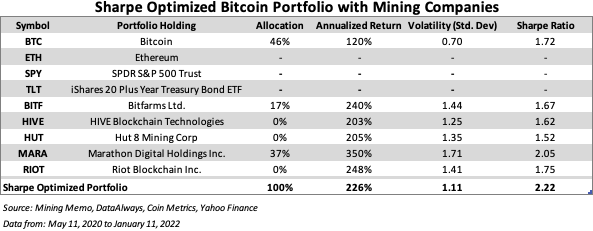

Bitcoin portfolio

The analysis is repeated below with ether exposure removed for those with fundamental objections to cryptocurrencies other than bitcoin.

It should not be surprising that removing a well-performing and diversifying asset from your portfolio negatively effects the risk-adjusted returns.

Without the ether exposure we see that bitcoin becomes the largest recommended holding as the increased returns of the bitcoin mining companies largely come at the expense of outsized volatility.

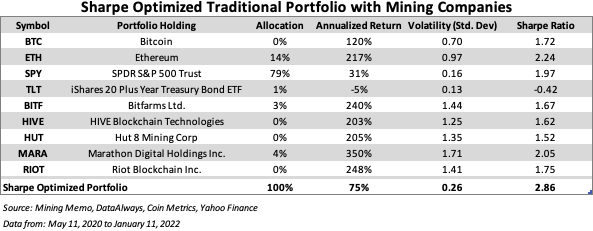

Portfolio with S&P 500 exposure

The analysis is repeated again, but modified to add in a traditional portfolio base with an S&P 500 ETF (SPY) and a long-duration bond ETF (TLT).

Given the strong performance of the traditional markets and the weak treasury environment, it falls in line with expectations that the Sharpe optimal portfolio has a high S&P 500 weighting and negligible bond holdings. We see again that spot ether and bitcoin mining companies combine to give effective exposure to bitcoin while improving the return/volatility quotient.

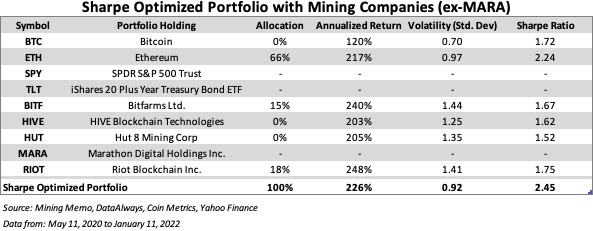

Sans MARA

As a final simulation, the original analysis is repeated while removing the best performing bitcoin miner from this cycle, Marathon Digital Holdings Inc. (MARA).

Comparing the results to the initial simulation, we see that the decrease in Sharpe Ratio is actually quite minimal. The bitcoin and ether correlations remain similar with the majority of Marathon’s allocation being redistributed to Riot Blockchain, and the weighting of Bitfarms increased by approximately 35%.

Simply put, it’s not crucial to pick the absolute best bitcoin miner for these optimizations to lead to better risk-adjusted performance.