Welcome to the latest release of Difficulty Adjustment. With huge firms such as Square Crypto, Grayscale, and MicroStrategy ramping up their Bitcoin buying activities, it's about time that somebody puts the gigantic amount of BTC being swooped up by these companies into context.

The amount of BTC being bought by these firms is commonly compared to the Bitcoin being mined. As we will highlight in this analysis, it is relatively futile to make this comparison as newly issued Bitcoin is only a minuscule portion of the market for acquiring BTC. Through an analysis of the Bitcoin unspent transaction output (UTXO) distribution, we will estimate the USD value of Bitcoin changing hands over the past three months. This will help put the amount demanded by large institutions into perspective and update readers on the latest demand-supply dynamics in the Bitcoin market.

Have you checked out the Proof of News podcasts series yet? Each week, Whit Gibbs and Ethan Vera cover the most relevant news in the mining world. In the latest episode, the duo covers how Chinese chip manufacturers are sniping TSMC executives and some positive developments for Bitmain.

Bitcoin Demand-Side Ramping Up

Several institutions have recently revealed that they have ramped up BTC buying activities. Square Crypto, Grayscale, and MicroStrategy have all disclosed that they have been purchasing enormous amounts of Bitcoin.

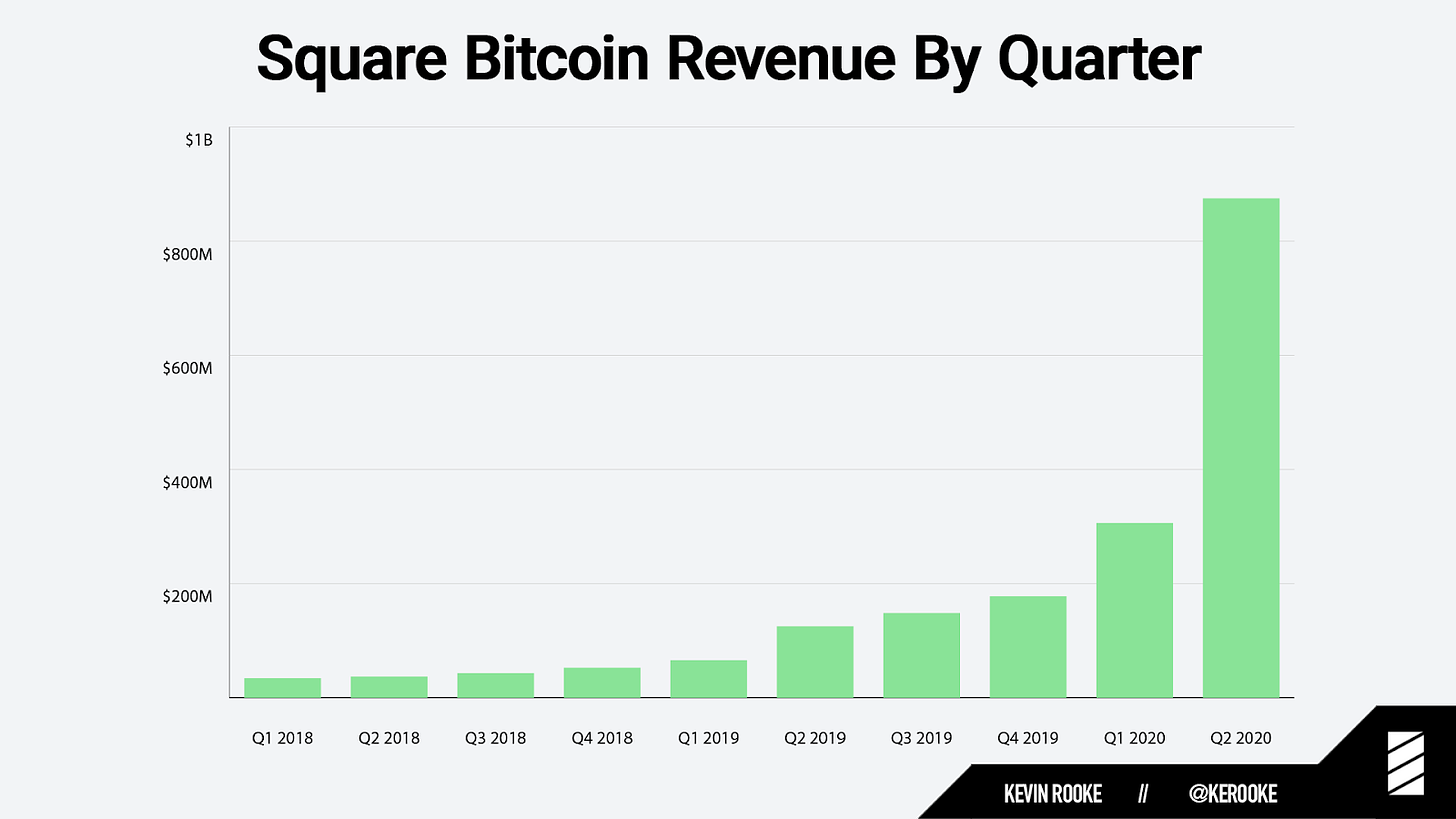

In their Q2 report, Square Crypto revealed that they had spent $858 million purchasing Bitcoin to facilitate Cash App sales. This is a significant jump from Q1 when $299 million was spent.

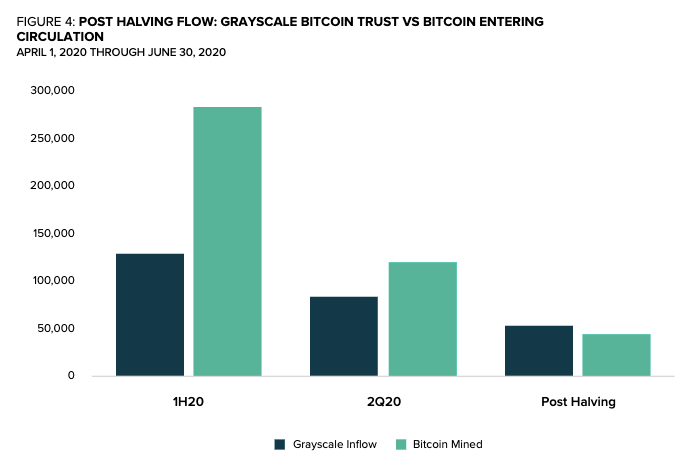

Grayscale – an institution which has provided an index that allows accredited investors to gain exposure to Bitcoin – also published their Q2 report. They reported inflows of $751 million into their Bitcoin GBTC product.

Grayscale has been providing the GBTC product since December 2013 and holds bitcoin in their trust to reflect the value of the GBTC shares. To account for the record inflows, Grayscale has had more Bitcoin flowing into the trust than there is being mined.

Nasdaq-listed MicroStrategy has joined the club of institutions with major Bitcoin purchasing activities after disclosing that it acquired $250 million worth of BTC. The firm is the first to purchase Bitcoin as part of an asset allocation strategy.

These three institutions alone accounted for demand of over $1.85 billion in the space of a few months. Start adding in other institutions with Bitcoin interests and the wider retail market and the demand-side figure quickly grows to a monstrous size. Nonetheless, this figure means little without putting the supply into perspective.

Bitcoin Supply-Side

One way this demand can be fulfilled is through newly issued Bitcoin. It doesn’t take much analysis to realise that the demand for Bitcoin vastly outweighs the BTC coming into issuance through block rewards.

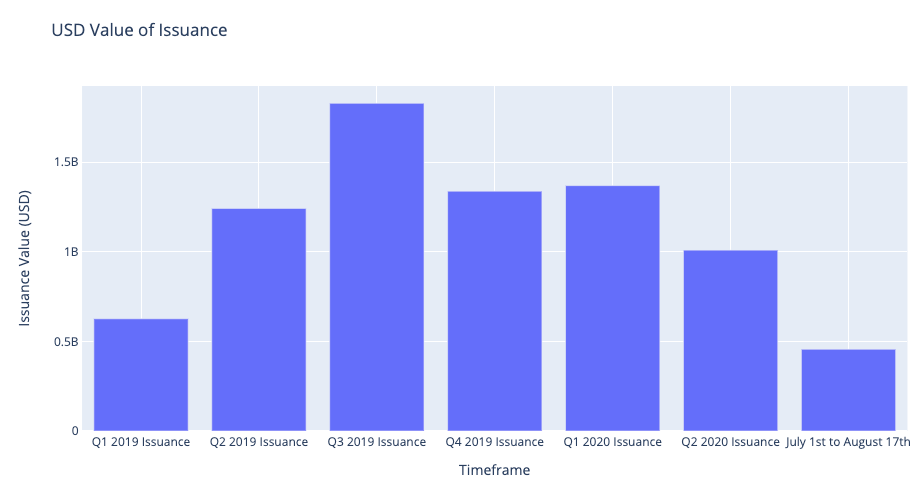

We are currently on track for the lowest USD value of newly issued Bitcoin in a quarter since Q1 2019. The May halving and slower block times have both played roles in pushing down this value.

With $456 million issued through the block subsidy so far this quarter, we can cater for just over half of the demand brought by Square alone in Q2. But as stated above, newly issued Bitcoin is only one of the ways we can cater for demand.

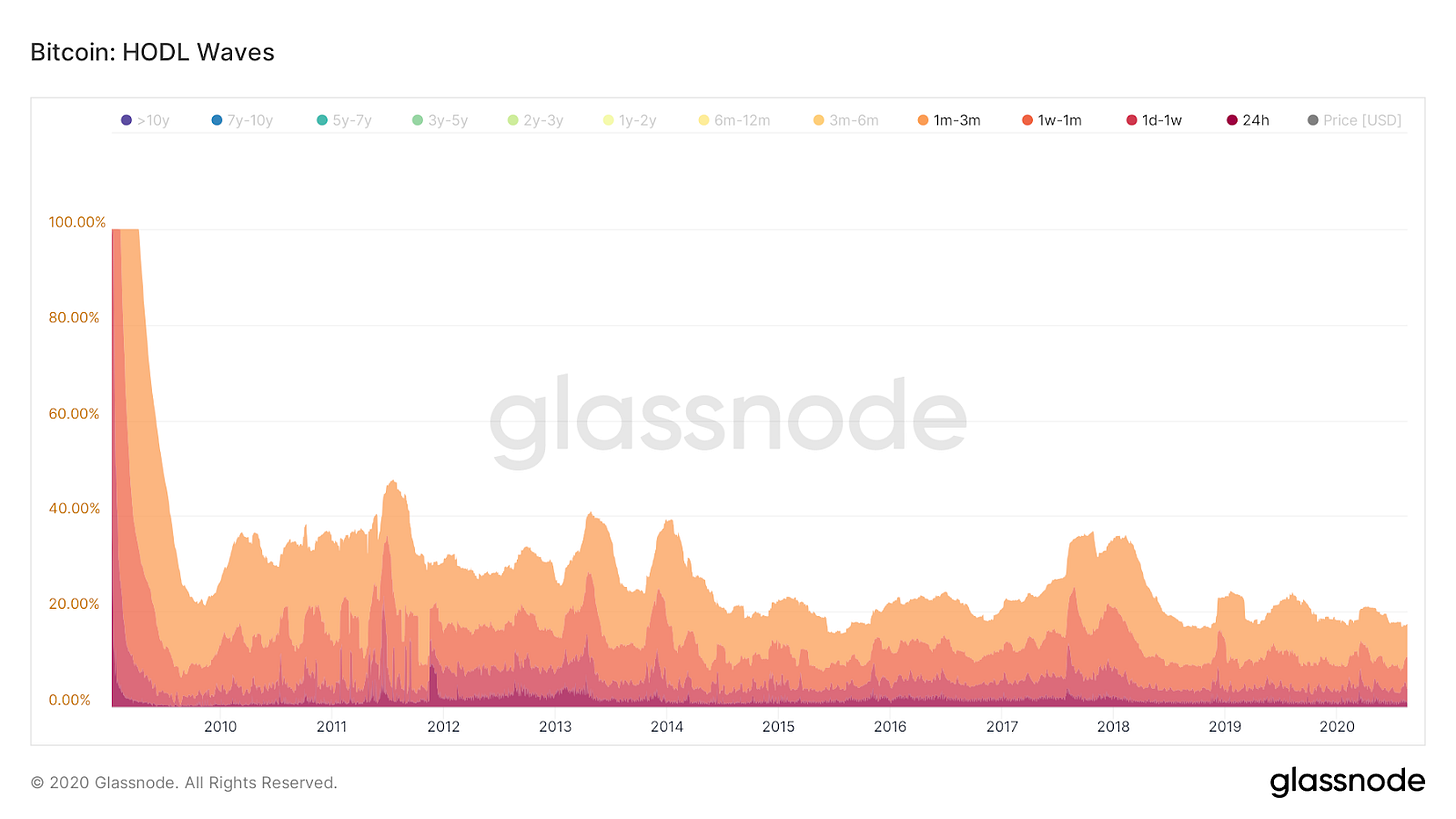

It is difficult to gauge how much Bitcoin is readily available by holders to be sold but we can analyse the Bitcoin unspent transaction output (UTXO) distribution to make some estimates regarding the market. Bitcoin transactions consist of inputs and outputs and the amount of BTC held in any given wallet is the sum of all UTXOs sent to that address.

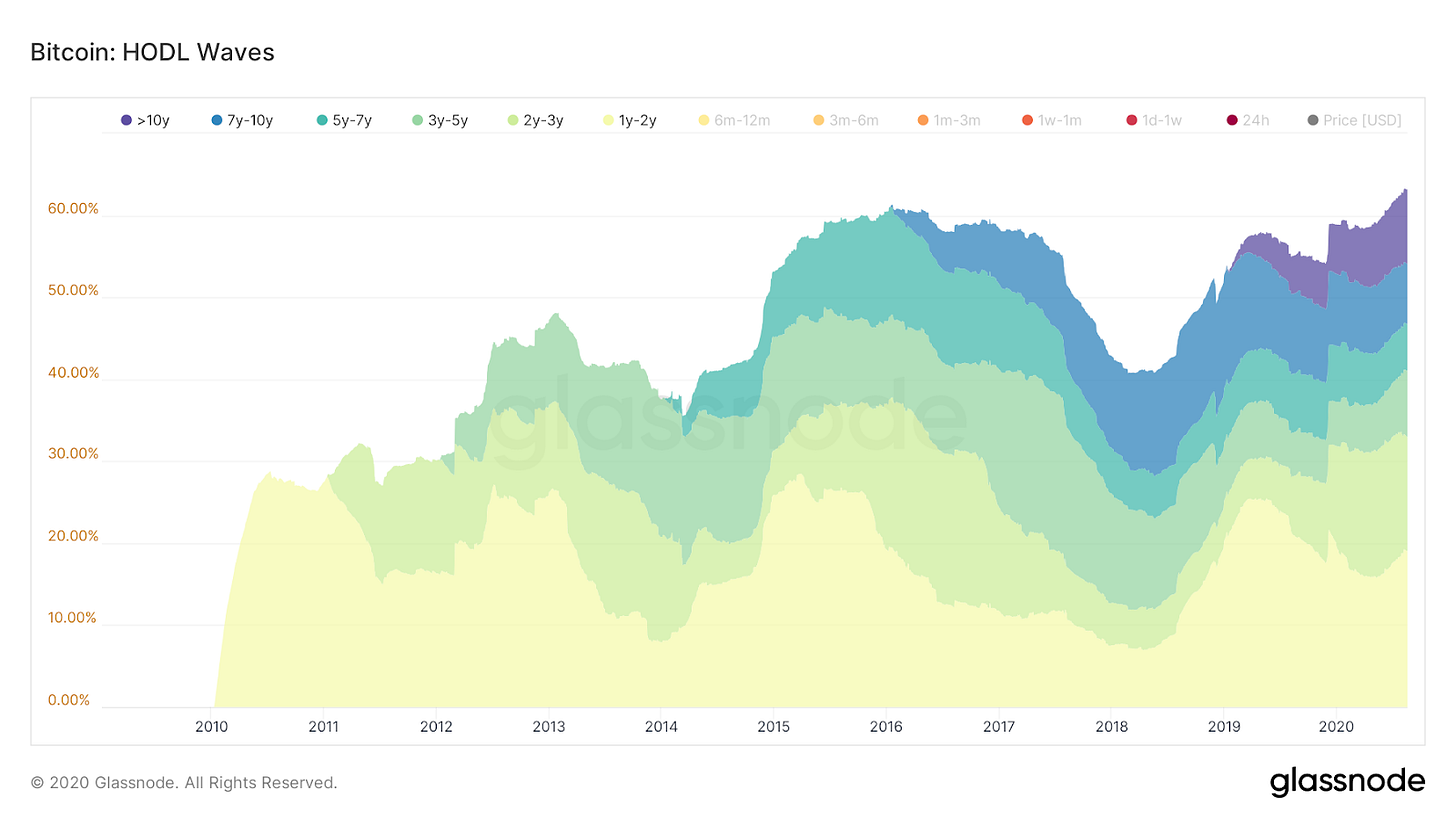

UTXOs that have been unmoved for one year or longer are currently at a record high of 63%. With a higher percentage of current holders demonstrating an unwillingness to move their coins at current prices, demand-side players are buying in a market with constricted supply. As price grows, willingness to move coins also grows and this figure will be expected to drop as illustrated by the deep trough over 2017 and early 2018.

However, there is still a significant percentage of coins that holders are willing to move in the shorter-term. We can estimate how much USD value of Bitcoin is willing to change hands over a quarter by looking at UTXOs which have been moved within the last three months and relate this to circulating supply and price. 17.46% of UTXOs were moved within the last three months.

With the current circulating supply at $18.46 million, this means that roughly 3.2 million BTC were exchanged between addresses within the past three months. With an average closing price for the past 90 days of roughly $10k, approximately $320 billion worth of Bitcoin was exchanged between holders.

Newly issued supply quickly becomes insignificant for filling demand. Major purchasers like to draw comparisons of their buying activities to the amount of bitcoin being mined such as the Grayscale bar chart above. However, the high demand for Bitcoin can only be fulfilled by current holders. Higher prices need to materialize if that is insufficient and that is likely one of the factors driving the recent price jump.

There may be $1.85 billion worth of Bitcoin demanded by three institutions alone. But there is also $320 billion worth of value swapping hands between holders. Furthermore, recent rises in Bitcoin price is allowing more value to be transferred per satoshi. Don’t get me wrong, the demand-side for Bitcoin looks extremely healthy. But let’s stop comparing it to the size of newly issued Bitcoin.

- John

Miner Monitor

Sichuan is experiencing the most severe flooding in 70 years and it is taking its toll on Bitcoin hash rate. We previously covered how the relentless rainfall in China is destroying Chinese infrastructure and risking the lives of Chinese citizens residing in towns close to overflowing rivers. The downpour has continued with upstream cities in Sichuan experiencing power station shutdowns. Thomas Heller highlighted that around 10-15 EH/s dropped off from Chinese mining pools within 24 hours.

Lancium, a Texas-based company backed by SBI, is suing Layer1 over patent infringement. The lawsuit is specifically related to technology for “adjusting power consumption” which has been patented by Lancium. The specific patent can be accessed here.

Bitmain included on TSMC shortlist for 5nm chip production. Bitmain was one of seven companies that were assigned the bulk of TSMC’s initial 5nm chip production. This is an extremely positive development for Bitmain JF (Jihan Fork?). Access to the 5nm chip gives Bitmain a head start to produce a rig vastly more powerful than the current latest-gen rigs. Bitmain was the only ASIC manufacturer on the list. The other companies were Apple, AMD, Intel, MediaTek, Nvidia, and Qualcomm.

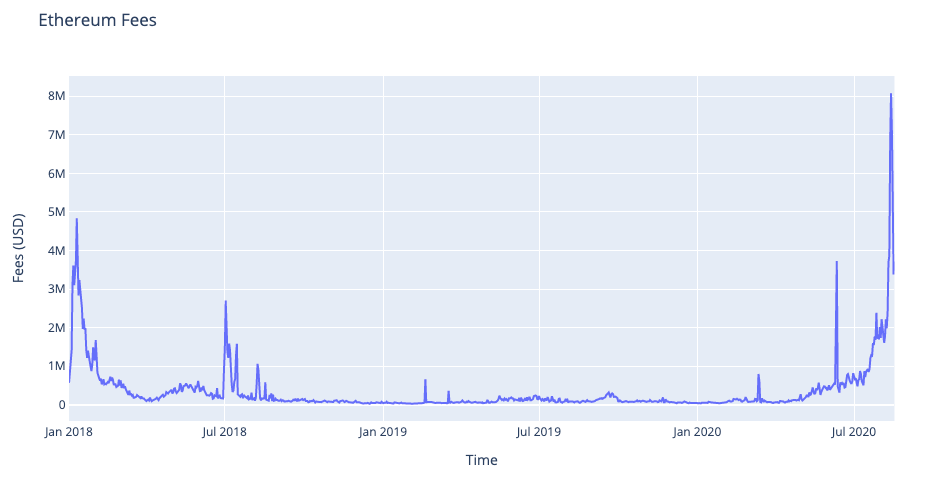

Ethereum daily transaction fees hit record highs amid Yam debacle. Daily Ethereum transaction fees have surpassed their previous record high of $4.55 million in January 2018. Daily fees spiked to $6.87 million on August 12th and further increased to $8.61 million on August 13th. The failure of the DeFi project YAM was a key driver behind the spike in network fees. YAM holders rushed to unstake their tokens from liquidity pools to participate in a governance vote to save the protocol. The effort ultimately failed.

About HASHR8

Mining is the misunderstood heartbeat of blockchain technology. It fuels multi-million dollar IPO’s and drives institutional investors to big datacenters; it’s infrastructure is the subject of speculation and skepticism. Our global reach helps us demystify and broadcast the thoughts of industry leaders, and keep research firms, investors, and consumers up-to-date on trends and insights.