In this week’s HASHR8 Difficulty Adjustment release, we detail some of the latest developments in the Bitmain drama and also analyse why Jihan and Micree may be acting the way they are. We also provide analysis on the upcoming Ebang IPO. The TLDR of the Ebang analysis is that an IPO asking price of roughly double Canaan’s entire market cap is ridiculous.

As per usual, we also deliver summaries of the most important mining news and developments. You can also find links to the latest HASHR8 podcasts which includes Cynthia Wu from Matrixport, Matthew Graham from Sino Global Capital, and Russell Cann from Core Scientific.

The Bitmain Dilemma – Jihan Jail Time on Cards?

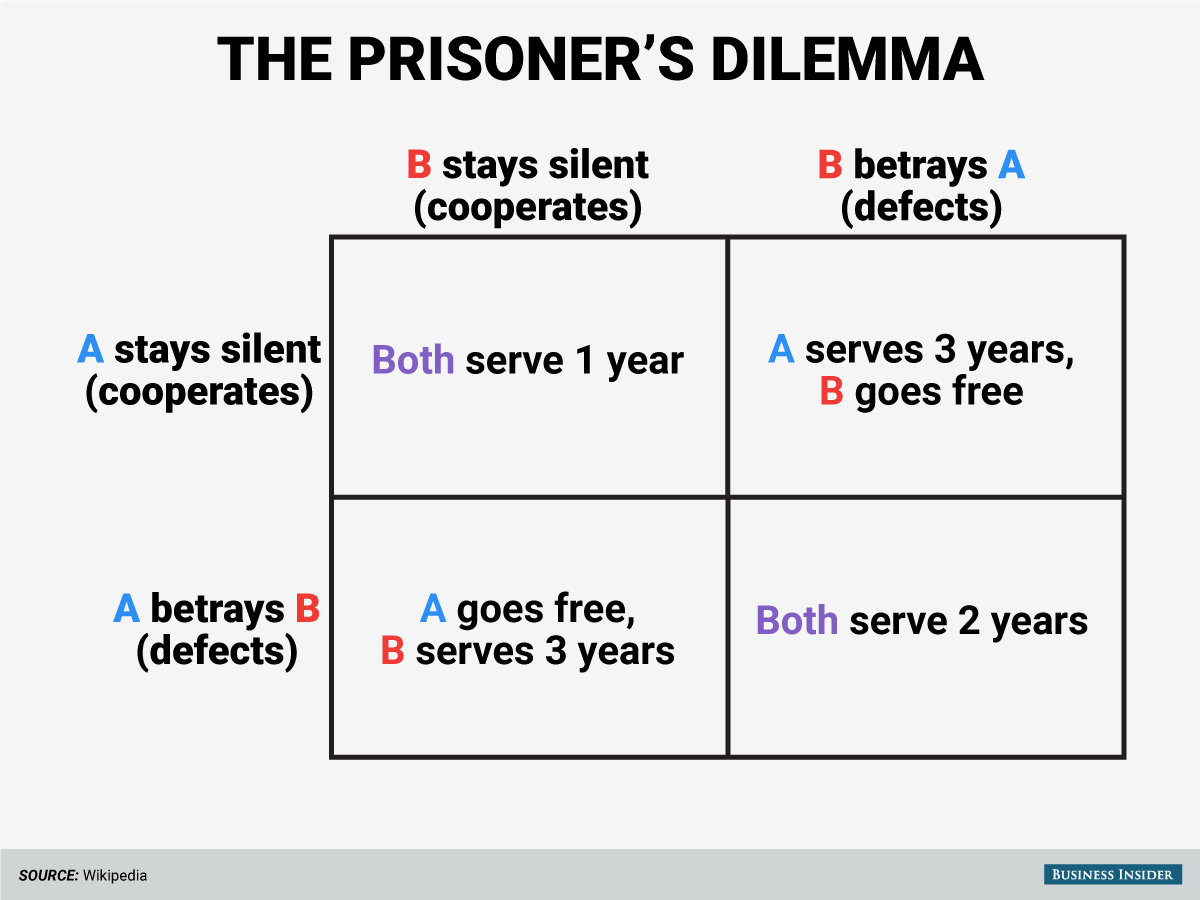

The prisoner’s dilemma is a textbook example used to explain the economic concept of game theory. Game theory deals with scenarios that have multiple participants. These participants each have incentives which pushes them to act in their best interest. But the rational acts of the individual often lead to a suboptimal outcome compared to if the individuals acted collectively.

The classic prisoner's dilemma has two bank robbers who are being interrogated separately. The interrogators have no accomplices or witnesses. Their conviction prospects depend upon one or both the prisoners cooperating. If both stay silent, they will be convicted on minor charges and both prisoners will be sentenced to one year in prison.

If one cooperates while the other stays silent, the one who cooperates will go free while the one who stays silent will be sentenced to three years. If both cooperate, they will each be sentenced to two years.

The optimal strategy collectively is for each to remain silent. The total time served will be two years, less than any of the other options. However, each of the prisoners does not know what the other will do so the rational choice is to cooperate.

Let’s come back to the prisoner's dilemma in a moment…

The drama at Bitmain has been getting hotter than Sichuan cuisine. It seems like the company hit the “self-destruct” button. Bitmain once had over 90% of the Bitcoin ASIC market and had immersed their business activities into almost every other commercial area related to mining. The revenue streams of the enterprise spanned ASIC manufacturing, proprietary mining, mining pools, and cloud mining. The talk of the mining community has been how this once-dominant superpower has been spiralling out of control.

Read More: A Timeline of the Bitmain Co-Founder Battle for Control

Bitmain’s troubles recently escalated as Micree Zhan returned and halted chip supplies to a Shenzhen subsidiary which is key to the manufacturing and delivery of Antminer rigs. On Sunday, Zhan made an announcement offering an explanation for stopping the chip supply. The announcement details that the chip supplies to the Shenzhen subsidiary have stopped until Zhan and his relatives are assured that the subsidiary is “committed to protecting the interest of Bitmain’s customers and of the company as a whole”.

Furthermore, the announcement targeted Jihan Wu by making accusations of forging company documents, coordinating the court fiasco where Micree’s business licence was seized, and embezzlement. Jihan faces serious time in jail if the accusations are investigated and turn out to be accurate.

The document also details that Zhan attempted to buy the shares of Jihan and other founding members at a company valuation of $4 billion. Either Jihan or Micree leaving the company is the clear route forward. According to social media posts and anecdotal accounts, the majority of employees in the company are believed to be on the side of Jihan.

Whether a valuation of $4 billion is hefty is up for debate. At a Bitcoin price of $9,600, roughly $3.1 billion in subsidy rewards are issued annually. This would mean the Bitmain valuation outsizes all rewards available to a miner in a given year. But the valuation would also take into account the ability to capture future value, goodwill (although rapidly depleting), the market position of Bitmain, and a myriad of other factors. Previous valuations have been even higher with a fundraising round in August 2018 valuing Bitmain at $14.5 billion.

As the back and forth between Micree and Jihan escalates, it appears that each may be hurting the other to improve their bargaining power in a negotiation. Despite the catastrophic mess Bitmain has caused over the past year, they remain an extremely valuable company. Their business activities span almost every aspect of mining. The best scenario for any equity holder in Bitmain is Jihan or Micree walking away from the table.

But that won’t happen without one buying the other out. In the meantime, both have set to destroying each other and improving their bargaining position. The dilemma lies in the fact that they risk destroying Bitmain in the process. Although it’s in both Jihan and Micree’s current interests to oust the other, the reality is that the outcome will be far less desirable than if they could have collectively come to an agreement.

Ebang Exit Scam IPO

Ebang is set to IPO on NASDAQ this Friday June 26th, with an intended raise of up to $125 million at a valuation of ~$721 million.This development comes after an updated prospectus estimates a net loss of $2.5 million for Q1 2020.

Analysts have been highlighting concerns relating to Ebang. A deep dive into financial reports by Matt Yamamoto shows the shaky foundation of the firm. A high percentage of Ebang’s revenue comes from just a handful of customers in the Chinese market. As the report also mentions, the firm had a high profile falling out with one such customer.

Ebang is severely lagging behind competitors such as Bitmain and MicroBT. Ebang’s most powerful rig model, the Ebit 12, is about half as efficient as the newest generation of Antminer and Whatsminer rigs. The Ebit 12 advertises a power efficiency of 57 J/TH while the leading rigs on the market are around 30 J/TH. Another alarm bell was the evaporation of revenue in the second half of 2018 and 66% year-on-year decline in revenue in 2019.

The best comparison in all avenues is Canaan. In 2019, Canaan had ~12% market share, whereas Ebang had 4%. In terms of product efficiency, Ebang is lagging even behind Canaan. Ebang’s Ebit 12 rig runs at 57 J/TH whereas the Canaan Avalon 1146 runs at 42 J/TH.

Canaan IPO'd on the NASDAQ in November 2019 and the share price has since depreciated by nearly 80%. The company is now valued at ~$320 million. The ebang asking price is two times higher than what Canaan is currently valued at. All for...

- A less efficient product

- Evaporating market share

- R&D laggard in a technological sector

- Demonstration of opaqueness in business practice and management

We understand that an IPO is a way to rescue the falling cash flow and resurrect the company’s balance sheet. However, attempting to dump on potential investors shines a bad light on the industry.

The Canaan IPO was impeccably timed. The IPO was pulled off ahead of a set of financial results which would record huge losses. In the aftermath, Canaan received strong criticism from those in the industry. The decision to choose immediately after the IPO to make significant inventory impairments has caused outrage. Furthermore, short sellers have taken notice of the stock and put forward analysis which suggests that fraudulent activity may have been carried out in the lead-up to the Canaan IPO. If Ebang manages to successfully raise at their desired valuation, we can only see the aftermath being far worse.

What Miners Are Monitoring

Another IPO which earns the eyeballs of crypto miners is the approval of SMIC to list on the Shanghai Stock Exchange. SMIC is among the largest chip foundries globally. We previously reported that it was certainly in the Chinese government's interests to have this IPO be a success. The strengthening relationship between TSMC and the US increases the importance of China having a domestic alternative. The IPO has been approved to take place in July and SMIC intends to raise $2.8 billion.

Chinese crypto media outlet 8BTC reports severe mudslides in Sichuan. Several crypto mining farms have been destroyed after mudslides hit a town in Sichuan province. A power plant in the region has also been impacted. Risks of mudslides in Sichuan arise when the rainy season takes place each year from roughly April to October.

HASHR8 Insider

- Babel Finance, a Chinese firm that provides financial services to crypto traders and miners, is believed to be setting up a Bitcoin mining pool

- ePIC Blockchain launching SiaCoin ASIC mining rigs. 1400 to 2000 units expected.

- Uptrend Podcast with Matt D’Souza & Whit Gibbs to launch this month.

HASHR8 Podcast Episodes

Making Crypto Easy with Cynthia Wu - Cynthia Wu leads the efforts at Matrixport who are at the frontier of providing financial services to miners. Cynthia was previously investment director at Bitmain. On the podcast, Cynthia details the products and services offered by Matrixport.

Blockchain Services Network with Matthew Graham - Beijing-based Sino Global Capital CEO Matthew Graham is at the heart of the Chinese blockchain industry. The Blockchain Service Network (BSN) is a Chinese project which has been launching nodes globally. Matthew explains exactly what the BSN is and the impact it could have.

Blockchain and AI Infrastructure with Russell Cann - The Chief Customer Success Officer for Core Scientific Russell Cann joins the podcast to detail his experience with running some of the largest hosting facilities in North America. Russell also dives into high performance computing and AI.

About HASHR8

HASHR8 is a community-driven bitcoin and crypto mining company focused on providing honest content, excellent products, and unparalleled customer service. HASHR8 produces weekly podcasts, videos, newsletters, and articles, as well as creating premium software products for bitcoin and cryptocurrency miners around the world. HASHR8 is Mining As It Should Be. Follow us on Twitter for all updates and new releases.