Bitcoin miners typically want to set up operations in places with low or no state income tax, cheap electricity rates, favorable crypto and business laws, average to high internet speeds, and low to moderate cost of living. The following states fit this criteria:

- Wyoming

- Texas

- Ohio

- Montana

- North Dakota

- Florida

Want more mining insights like this?

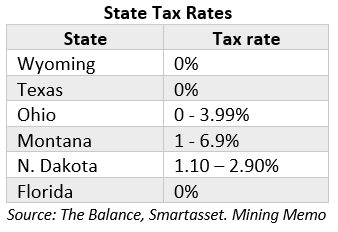

State power and tax rates overview

The tables below summarize some important data from this article. These six states offer competitive electric power and tax rates, making them attractive places for cryptocurrency mining operations.

1. Wyoming

Wyoming is one of the most crypto friendly places in the US. The state has low electricity costs and business laws that miners can use to their advantage.

Electricity cost

Wyoming’s residential, commercial, and industrial power rates are on average $0.0985/kWh, $0.0824/kWh, and $0.0603/kWh, respectively. The residential rate is 17.09% less than the U.S. national average rate of $0.118/kWh while the commercial rate is 18.33% below the national average rate of $0.10/kWh. (Read more)

Taxes

Wyoming does not have state income taxes.

Favorable laws

Bitcoin miners in Wyoming can take advantage of the Data Center Exemption Law. This law provides a sales tax exemption on purchases or rentals of:

- Computer equipment

- Computer software

- Equipment transport containers

- Racking systems, cabling, and trays

This exemption only applies to taxpayers making over $5 million. Calling all large scale miners! (Read more)

In addition, Wyoming laws recognize legally protected property rights for owners of all types of digital assets, including cryptocurrency. This makes the state a popular choice for crypto miners and investors who wish to operate through an LLC.(Read more)

2. Texas

Texas is synonymous with cheap power and favorable tax laws. Texas lawmakers have also gone on record for their support for bitcoin, other cryptocurrencies, and bitcoin mining.

Electricity cost

Texas residential, commercial, and industrial power rates are on average $0.1098/kWh, $0.0816/kWh, and $0.0557/kWh, respectively. The residential rate is 7.58% less than the U.S. national average rate of $0.118/kWh while the commercial rate is 19% below the national average rate of $0.10/kWh. (Read more)

Taxes

Texas does not have state income taxes.

Favorable laws

Texas’s H.B 4474 bill was signed into law this year. This law amends Texas’s Uniform Commercial Code to include a definition of “virtual currency” and ensures that key business laws apply to cryptocurrencies. (Read more)

Texas’s power grid is deregulated, this allows businesses, including miners, to choose between different power providers. This creates competition among providers, thus incentivizing them to offer lower rates. Mining facilities can also take advantage of this by negotiating long term contracts with fixed power pricing. (Read more)

3. Ohio

Ohio’s favorable tax law, cooler climate, and crypto friendly legislature make it an ideal state for bitcoin miners.

Electricity cost

Ohio’s residential, commercial, and industrial power rates are on average $0.1176/kWh, $0.0947/kWh, and $0.064/kWh, respectively. The residential rate is 1% less than the U.S. national average rate of $0.118/kWh while the commercial rate is 6% below the national average rate of $0.10/kWh. (Read more)

Taxes

Ohio state income tax ranges from 0%-3.99% depending on income level (Read more)

Developments

Ohio is working to become a crypto and mining friendly state. Recently, power provider, Energy Harbor Corp, is partnered with bitcoin mining hosting provider Standard Power to bring nuclear powered bitcoin mining to the State. (Read more)

4. Montana

Montana is another State that’s attractive for bitcoin mining, especially for larger scale miners.

Electricity cost

Montana’s residential, commercial, and industrial power rates are on average $0.10/kWh, $0.0913/kWh, and $0.051/kWh, respectively. The residential rate is 15.15% less than the U.S. national average rate of $0.118/kWh while the commercial rate is 9.5% below the national average rate of $0.10/kWh. (Read more)

Taxes

Although Montana’s top tax rate is 6.9%, residents can deduct Federal taxes on the state tax return. (Read more)

Favorable laws

Montana created a property tax classification for qualified data center equipment known as Class 17 property. Mining operations can qualify for this. Class 17 property is taxed at 0.9% of its market value. This classification is ideal for large scale miners. (Read more)

Qualifications

- 25,000 square feet floor area

- $50 million investment over a 48-month period

5. North Dakota

Here are a few reasons why North Dakota is also an attractive location for bitcoin mining operations.

Electricity cost

North Dakota’s residential, commercial, and industrial power rates are on average $0.09/kWh, $0.08/kWh, and $0.0655/kWh, respectively. The residential rate is 23.7% less than the U.S. national average rate of $0.118/kWh while the commercial rate is 20.5% below the national average rate of $0.10/kWh. (Read more)

Taxes

North Dakota state income tax ranges from 1.10-2.90%. (Read more)

Favorable laws

This year, state legislatures passed a law that gives tax breaks to oil and gas producers that provide flare gas to cryptocurrency miners. These arrangements provide miners with a cheap, abundant source of energy, while oil and gas producers monetize gas volumes that would have otherwise been wasted/flared. (Read more)

6. Florida

Florida politicians have said they want to attract miners to their state. Here are a few reasons why miners might consider moving.

Electricity cost

Florida’s residential, commercial, and industrial power rates are on average $0.114/kWh, $0.096/kWh, and $0.084/kWh, respectively. The residential rate is 23.7% less than the U.S. national average rate of $0.118/kWh while the commercial rate is 20.5% below the national average rate of $0.10/kWh. (Read more)

Taxes

Florida does not have state income taxes.

Developments

Miami Mayor, Francis Suarez, is actively working to bring cryptocurrency miners and companies into the state. Bit Digital is one bitcoin miner who decided to relocate. (Read more)

Conclusion

These states recognize that bitcoin mining is an economic activity, and that mining facilities and ASICs are critical infrastructure. The combination of favorable electricity rates, legal environment, and low taxes make the above states ideal for bitcoin miners. As the value and use of cryptocurrencies increase, more states will pass favorable legislation or offer incentives to attract miners.